Carnival Corporation (CCL) will report its Q3 results tomorrow, September 29, and Wall Street expects steady growth. Analysts project earnings per share between $1.31 and $1.32, which would be a 3% to 4% increase from $1.27 a year ago. Revenue is expected to land between $8.09 billion and $8.11 billion, reflecting a 2% to 3% gain from last year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The outlook is supported by strong travel demand and record bookings. Occupancy rates above 112% are seen as a key driver, while firm pricing trends add further support. At the same time, higher costs remain a focus, with analysts pointing to rising cruise operating expenses excluding fuel, along with new destination spending and advertising. In the meantime, CCL shares have climbed a respectable 22% year-to-date.

Analyst View

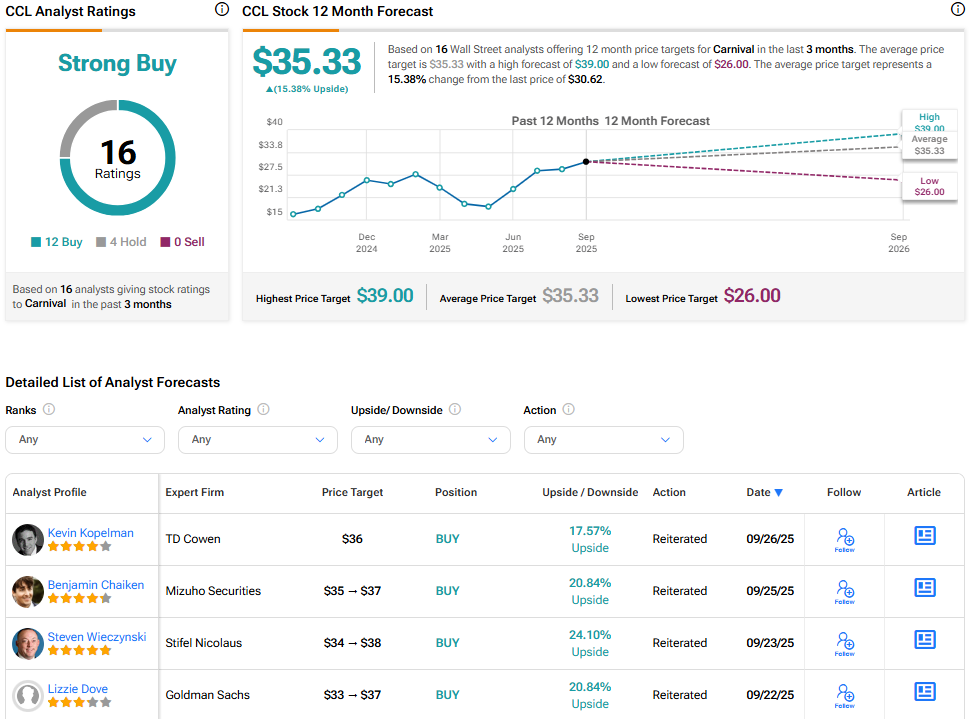

Several analysts highlight Celebration Key, Carnival’s new private island, as a meaningful growth factor. Mizuho four-star analyst Ben Chaiken raised his target to $37 and reiterated a Buy rating, noting that the stock remains compelling as Celebration Key ramps up. TD Cowen’s own four-star analyst Kevin Kopelman set a $36 target with a Buy rating, while Stifel Nicolaus and Goldman Sachs also expect shares to trade in the mid $30s. Overall, sentiment from Wall Street shows continued conviction in Carnival’s growth path.

Focus for Investors

In Q2, Carnival delivered record performance, with net income more than tripling and operating income rising 67%. The company also strengthened its balance sheet by paying down $350 million in debt. Looking ahead, investors will focus on whether Carnival can maintain yield momentum while absorbing higher costs.

Altogether, expectations point to another solid quarter, backed by strong demand and new destination offerings. The key test will be whether Carnival can protect its margins while funding fleet upgrades and new programs.

Is CCL Stock a Buy?

On the Street, analyst sentiment on Carnival Corporation remains positive. Out of 16 recent ratings, 12 are a Buy. The average CCL stock price target is $35.33, which suggests more than 15% upside from the current share price.