Used vehicle retailer CarMax (NYSE: KMX) slid in pre-market trading on Thursday after disappointing Fiscal second-quarter results. The company’s retail used unit sales fell by 7.4%, with comparable store used unit sales dropping by 9%. CarMax bought 292,000 vehicles from consumers and dealers, a 14.9% decline year-over-year. Even the company’s CarMax Auto Finance (CAF) income decreased by 26.2% to $135.0 million in Q2 due to net interest margin compression and higher loan loss provisions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The retailer reported Q2 earnings of $0.75 per share as compared to $0.79 in the same period a year back and in line with analysts’ estimates. The company’s net revenues declined by 13.1% year-over-year to $7.1 billion as compared to Street estimates of $7.02 billion.

Bill Nash, CarMax’s President and CEO commented, “We continue to drive sequential improvements in our business despite persistent widespread pressures across the used car industry. Through deliberate steps we are taking to control what we can, we delivered strong retail and wholesale gross profit per unit, reduced SG&A, and stabilized CAF’s net interest margin.”

CarMax intends to resume share repurchases in the third quarter.

Is KMX a Good Stock to Buy?

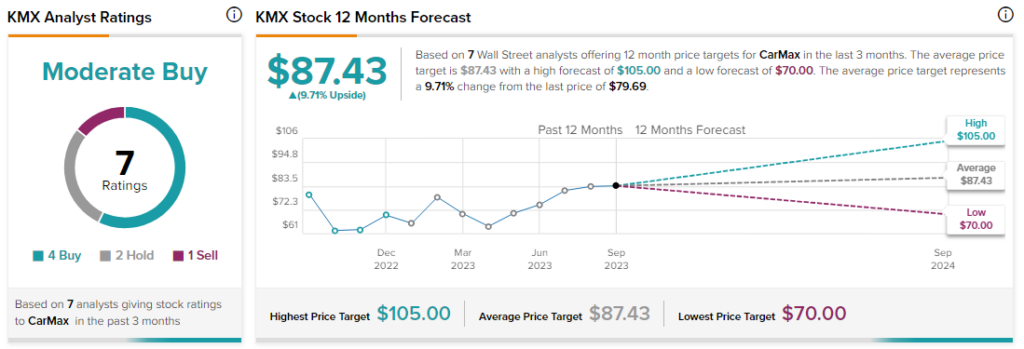

Analysts are cautiously optimistic about KMX stock with a Moderate Buy consensus rating based on four Buys, two Holds, and one Sell.