CarMax (KMX) shares tumbled more than 23% after it announced the unexpected departure of CEO Bill Nash, who had led the used car retailer since 2016, and provided a weak preliminary outlook for its fiscal third quarter. This triggered a wave of analyst downgrades due to concerns about the company’s near-term performance.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company announced that board member David McCreight, who has about 20 years of experience with major retail brands, will step in as interim CEO, starting December 1, 2025. While McCreight brings wide experience, investors are worried about the sudden transition at a time when CarMax is already under pressure.

At the same time, Tom Folliard, CarMax’s former CEO and current board chair, will now serve as Interim Executive Chair.

Importantly, the company said the search for a permanent CEO is being supported by the executive search firm Russell Reynolds Associates.

CarMax Warns of Weak Q3

The leadership shakeup comes as CarMax faces a tough quarter. The company expects used unit sales to drop between 8% and 12%. Also, KMX projects EPS to land in the range of $0.18 to $0.36, including non-recurring costs tied to the leadership change and workforce reductions. This is significantly below analysts’ estimates of $0.69 per share.

The company disclosed several factors that dragged down its Q3 results, including falling retail sales, depreciation in its wholesale business, and rising marketing costs as CarMax launches a new brand campaign.

Analyst Downgrades Deepen KMX Stock’s Slide

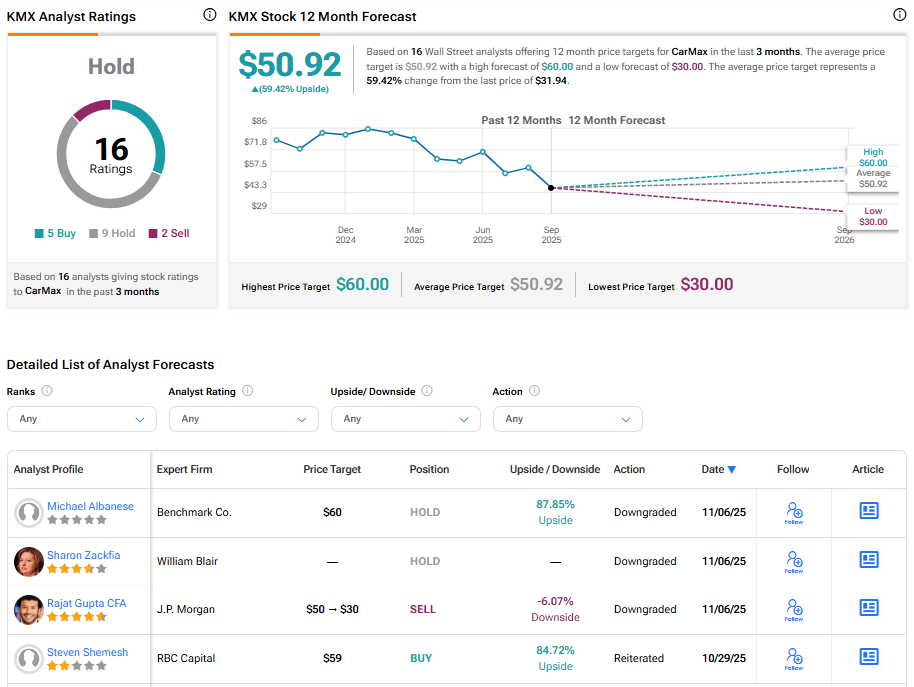

Adding to the selloff, three analysts downgraded KMX stock following the announcement. Among those, JPMorgan analyst Rajat Gupta, CFA, downgraded CarMax to Sell and cut the price target to $30 from $50, citing ongoing market share losses and margin pressure with no quick fix in sight.

Also, William Blair analyst Sharon Zackfia downgraded KMX stock to Hold, citing concerns about worsening trends and leadership changes.

Is CarMax a Good Stock to Buy?

On TipRanks, KMX stock has received a Moderate Buy consensus rating, with five Buys, nine Holds, and two Sells assigned in the last three months. The average CarMax stock price target is $50.92, suggesting an upside potential of 59.42% from the current level.