Before market open today, Cargojet (TSE:CJT) (OTC:CGJTF), a Canadian air transportation services company, released its Q1-2023 earnings results. The company reported total revenues of C$231.9 million, missing expectations of C$237.3 million and decreasing slightly from last year’s C$233.6 million. Meanwhile, Cargojet’s earnings per share (EPS) came in at C$1.67, beating expectations of C$1.11. As a result, the stock is rallying today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, CJT’s gross profit for the quarter was C$45.5 million compared to C$66.9 million in Q1 2022, translating to a gross profit margin of 19.6% compared to 28.6%. Also, adjusted EBITDA stood at C$75.0 million, down from the previous year’s Q1 figure of C$83.0 million.

Adjusted free cash flow came in at C$42.5 million, nearly the same as the C$42.7 million recorded in 2022, and net income for the quarter was C$30.5 million (C$6.0 million excluding warrant valuation gain) compared to a net loss of C$56.4 million in 2022 (C$30.4 million excluding warrant valuation loss).

Dr. Ajay Virmani, Cargojet’s President and CEO, highlighted the changes in consumer behavior during the post-pandemic period. As consumers prioritized travel and leisure, spending on goods decreased, impacting the company. However, he expects a more balanced mix of spending between goods and services as consumption behaviors normalize later this year.

Is Cargojet Stock a Buy, According to Analysts?

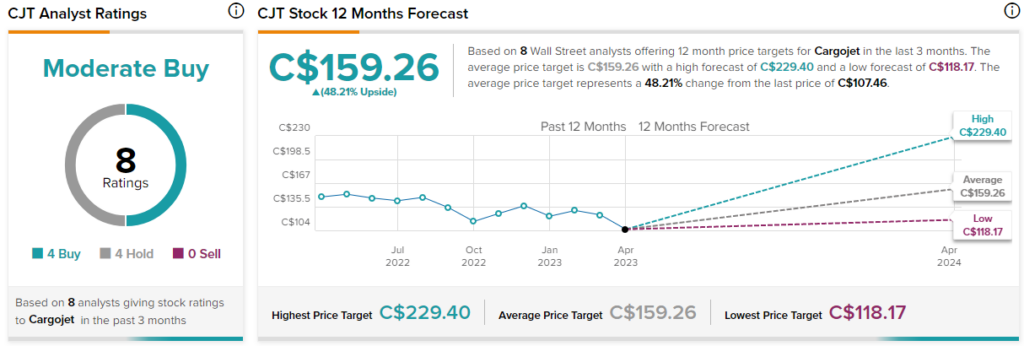

According to analysts, Cargojet stock earns a Moderate Buy consensus rating based on four Buys and four Holds assigned in the past three months. The average Cargojet stock price forecast of C$159.26 implies 48.2% upside potential. Analyst price targets range from a high of C$229.40 to a low of C$118.17.