Before market open today, Cargojet (TSE:CJT) (OTC:CGJTF), a Canadian air transportation services company, released its Q2-2023 earnings results. The company reported total revenues of C$209.7 million, missing expectations of C$223.4 million and notably lower than last year’s C$244.6 million. Meanwhile, Cargojet’s earnings per share (EPS) came in at C$0.91 compared to C$1.51 in Q2 2022, which beat the expectations of C$0.83, nonetheless. As a result, the stock is higher today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Additionally, Cargojet’s adjusted EBITDA margin improved from 32.9% to 35.4% year-over-year, but adjusted EBITDA fell by 8.4% to C$74.3 million. On the flip side, adjusted free cash flow increased from C$41.2 million to C$52.3 million.

In the press release, Dr. Ajay Virmani, Cargojet’s President and CEO, stated, “To prepare Cargojet to ride the current economic cycle, we shifted our focus to cost management as well as right sizing our network, while curtailing growth CapEx and focusing on generating free cash flow.”

The plan to generate more free cash flow seems to be working. However, CJT’s gross profit margin for the quarter was 20.3% compared to a gross margin of 24.8% last year. Nevertheless, the company expects “the shift in consumer spending towards travel and leisure vs goods” to normalize near the end of the year, which should positively impact its operations.

Is Cargojet Stock a Buy, According to Analysts?

According to analysts, Cargojet stock earns a Moderate Buy consensus rating based on two Buys and two Holds assigned in the past three months. The average Cargojet stock price forecast of C$148.34 implies 47.4% upside potential.

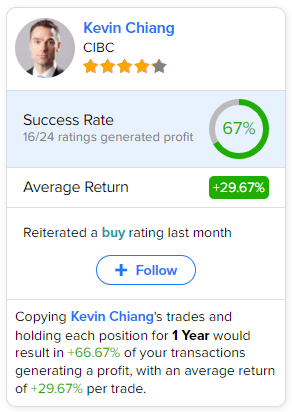

If you’re wondering which analyst you should follow if you want to buy and sell CJT stock, the most accurate analyst covering the stock (on a one-year timeframe) is Kevin Chiang of CIBC, with an average return of 29.67% per rating and a 67% success rate. Click on the image below to learn more.