Shares of healthcare solutions provider CareDx (NASDAQ:CDNA) are plummeting today after its first-quarter numbers fell short of estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue declined 2.7% year-over-year to $77.3 million missing expectations by nearly $3.4 million. Moreover, Net loss per share at $0.11 fell short of estimates by $0.01. During the quarter, total AlloMap and AlloSure tests rose by 17% to 49,000. Further, its Patient and Digital Solutions business clocked a 39% growth during this period.

Importantly, CareDx withdrew its revenue outlook for 2023 owing to uncertainty stemming from the revisions in billing articles in March and May 2023. Consequently, investor sentiment took a hit, and shares of the company are down nearly 17% at the time of publishing today.

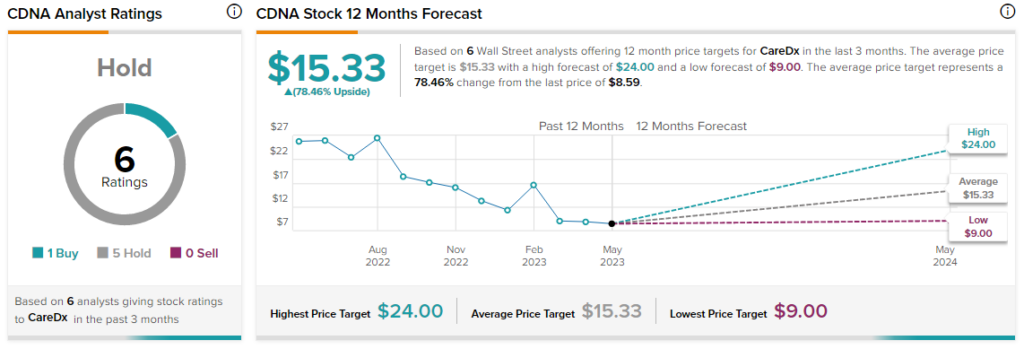

Overall, the Street has a $15.33 consensus price target on CareDx alongside a Hold consensus rating.

Read full Disclosure