Shares of Cardtronics closed 15.1% higher on Friday after the non-bank automated teller machine (ATM) operator received a higher buyout offer from an unnamed third party.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cardtronics (CATM) said that the third party has proposed to buy all of its common stock for $39 per share. Shares last closed at $41.08. The offer comes after the ATM operator entered into a buyout agreement with Catalyst Holdings on Dec. 15, 2020. Per the deal, Catalyst Holdings agreed to acquire all of its shares at $35 per share in cash. Cardtronics stated that the acquisition agreement with Catalyst remains in full force and effect.

Notably, Catalyst revised its offer price upward to $35 from the initial proposal of $31 per share offered on Dec. 9. (See CATM stock analysis on TipRanks)

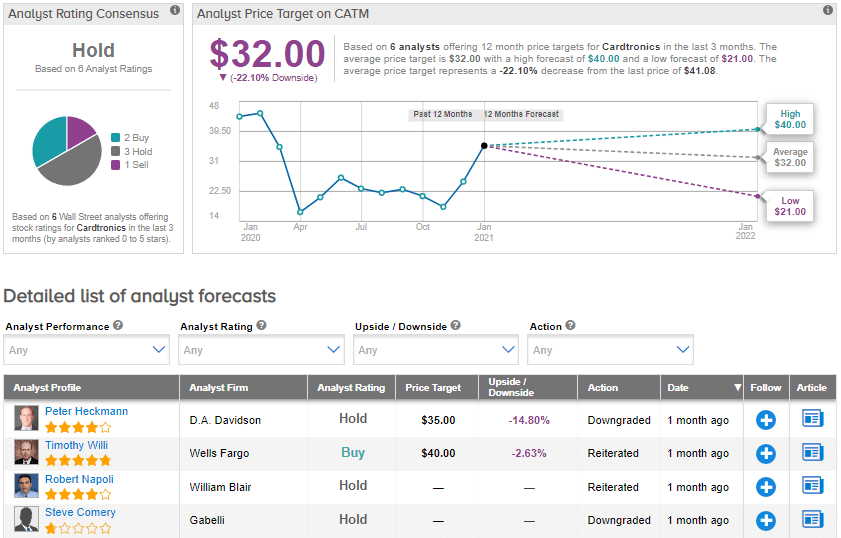

On Dec. 10, Wells Fargo analyst Timothy Willi raised the stock’s price target to $40 (2.6% upside potential) from $35 and reiterated a Buy rating. In a note to investors, Willi said that the $31 per share offer is just a starting point and he expects buyout offer prices to go higher with the entry of new bidders.

Overall, the consensus among analysts is a Hold based on 3 Holds, 2 Buys, and 1 Sell. The average price target of $32 implies downside potential of around 22.1% over the next 12 months. Shares have declined 3.9% over the past year.

Related News:

Domtar Slips 5% On Personal Care Unit Sale Deal

Roku Pops 5% On Quibi Catalog Content Deal

Wyndham Buys Travel + Leisure For $100M; Analyst Lifts PT