Sometimes, all it takes to give a stock a little extra edge is a new product. For cannabis stock Canopy Growth (TSE:WEED) (NYSE:CGC), that was indeed all it took. Canopy Growth shares were up just under 1.5% in Wednesday afternoon’s trading

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Canopy Growth brought out a new line of cannabidiol (CBD) gummies backed up by no less a force than the doyenne of domesticity, Martha Stewart herself. The new release is designed to capitalize on a customer trend that’s seeing marijuana users moving away from cannabis for recreation and over to cannabis as a component of overall wellness.

The new CBD gummies are particularly useful for relieving stress, reports note, as well as improving sleep and reducing aches and soreness in joints. That alone could draw plenty of attention, especially among older customers who frequently have sleep issues and joint pain problems.

A Burgeoning Market

While the end purpose of CBD and similar product users may be changing, there are some signs the market might be on the rise as well. Recently, one report noted that Ohio passed marijuana legalization measures for adults, which gives Canopy Growth and its contemporaries in the field a little more market to work with — and quite a market, too. Projections suggest that Ohio’s pot market will be worth around $4 billion over the next several years.

Yet, those same projections suggest that Canopy Growth may not be in the best position to capitalize on those legal changes in the U.S., thanks to an overall “somewhat confusing” set of plans for the U.S. market.

Is Canopy Growth a Good Stock to Buy?

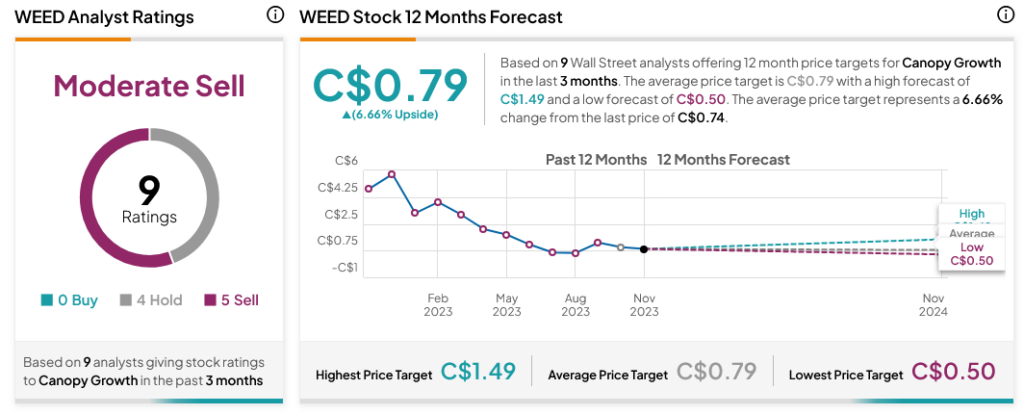

Turning to Wall Street, analysts have a Moderate Sell consensus rating on WEED stock based on four Holds and five Sells assigned in the past three months, as indicated by the graphic below. After an 84.77% loss in its share price over the past year, the average WEED price target of C$0.79 per share implies 6.66% upside potential.