Cannabis company Canopy Growth Corp. (TSE:WEED) (NASDAQ:CGC) dropped in pre-market trading after it announced that it had entered into a subscription agreement as of January 9, with institutional investors in a private placement offering. The private placement is for 6.9 million units at $4.29 per unit for aggregate gross proceeds of around $30 million. The price per unit was below CGC stock’s closing price of $5.04 on Monday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The offering aims to boost Canopy Growth’s liquidity by $30 million, enhancing its financial position. The proceeds will primarily go towards debt repayment, aligning with the company’s strategy for overall debt reduction, general corporate purposes, and working capital.

Each unit of the private placement offering will consist of one common share and either a Series A or Series B Warrant, allowing the holder to buy one share for $4.83. Series A Warrants will be exercisable immediately after the closing of the offering for five years, while Series B Warrants will become exercisable six months after the closing of the offering and will last for five years.

The private placement is expected to close around January 10, subject to closing conditions.

What is the Future of CGC Stock?

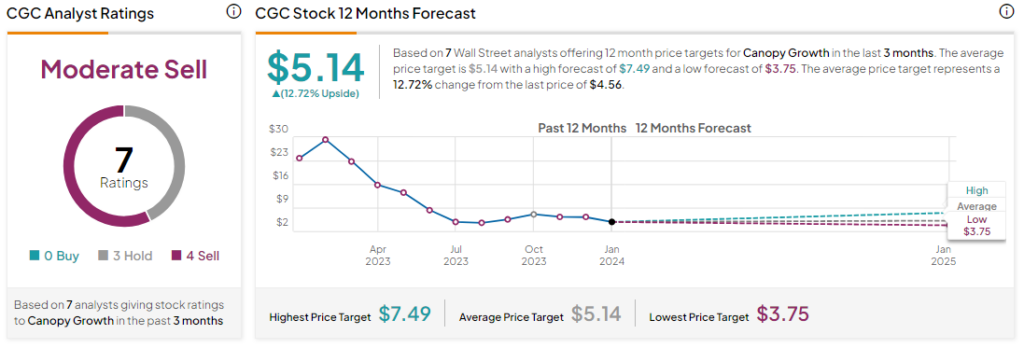

Analysts remain bearish about CGC stock with a Moderate Sell consensus rating based on three Holds and four Sells. CGC stock has already declined by more than 75% over the past year, while the average CGC price target of $5.14 implies an upside potential of 12.7% at current levels.