Canoo Inc. (NASDAQ:GOEV) shares surged nearly 10% in the pre-market session today after the electric vehicle maker announced its third-quarter results. Tony Aquila, the Executive Chairman, Investor, and CEO of Canoo, noted that the company has now reached the manufacturing and revenue-generation phase after nearly three years of efforts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

During the quarter, EPS of -$0.07 came in narrower than the Street’s expectations by $0.05. However, revenue of $519,000 missed estimates by about $83,000. Importantly, Canoo is making significant strides in manufacturing as the company advances towards its goal of reaching a 20,000 annual unit capacity.

In Q3, Canoo surpassed 10,000 industrial and commercial-use miles in pilot and customer delivery testing. Further, it has commenced assembling workforce at its Oklahoma facilities.

The company had a cash pile of nearly $8.3 million at the end of the quarter. It expects adjusted EBITDA to be in the range of -$85 million to -$105 million in the second half of Fiscal year 2023. Capital expenditures during this period are anticipated to hover between $30 million and $40 million.

Is GOEV a Good Stock to Buy?

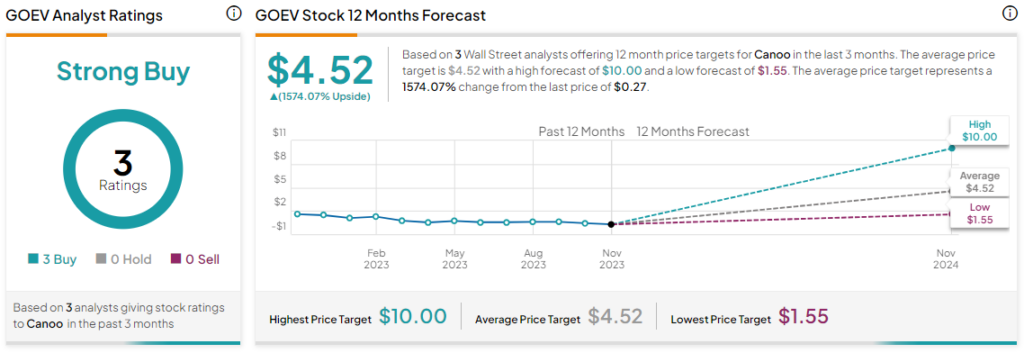

Overall, the Street has a Strong Buy consensus rating on Canoo. Following a nearly 82% slide in the company’s share price over the past year, the average GOEV price target of $4.52 implies a potential upside of over 1,500%.

Read full Disclosure