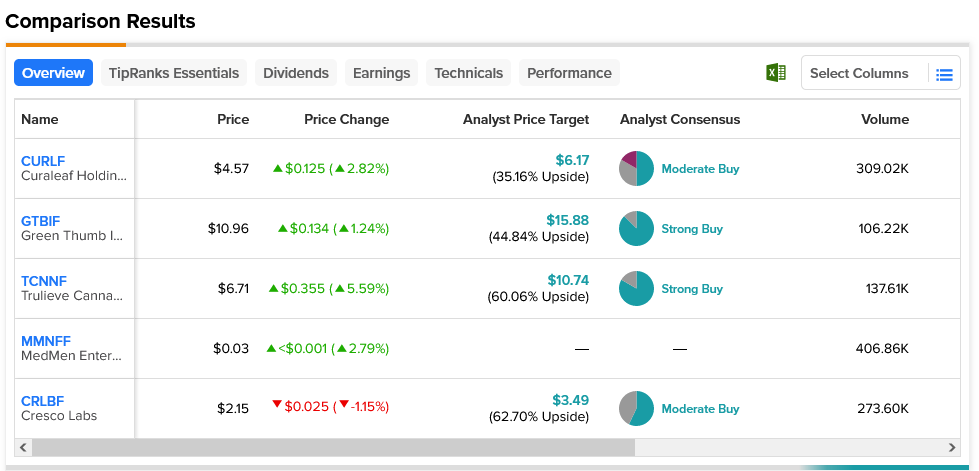

It’s a good day to be a cannabis stock, as demonstrated by the performance of several such stocks in Wednesday afternoon’s trading. The reason for the nearly simultaneous uptick is both surprisingly clear and simple: the SAFE Banking Act is gaining ground in the U.S. Senate. That sent several cannabis stocks up, including Curaleaf Holdings (OTHEROTC:CURLF), Green Thumb Industries (OTHEROTC:GTBIF), Trulieve Cannabis (OTHEROTC:TCNNF), and MedMen Enterprises (OTHEROTC:MMNFF) up accordingly. However, some cannabis stocks turned down as though seeking to be the exception that proves the rule, like Cresco Labs (OTHEROTC:CRLBF), down fractionally in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SAFE, as it was previously known, is off the books. However, the new version—now known as the Secure and Fair Enforcement Regulation (SAFER)–looks to have everything SAFE did and then some. SAFER hasn’t actually been filed yet, let alone voted on. Yet, reports note that it enjoys “bipartisan support,” suggesting that it’s likely to actually get through the process once it comes to a vote.

Some changes were made in order to turn SAFE into SAFER. Where under SAFE, the FDIC had 180 days to develop guidance for banks on taking cannabis business deposits, SAFER will give them a year. Further, banking regulators will now be obliged to work with their state equivalents as well as both the secretary of commerce and the secretary of the treasury. Further, regulators will need “valid” reasons to shut down a marijuana business’ account, as well as any other business. There were some concerns about the degree of notice required for account termination and how this may tip off “bad actors” before enforcement could step in.

Is Trulieve Cannabis a Buy or Sell?

Trulieve Cannabis was the biggest gainer out of the five mentioned previously. However, with a Strong Buy recommendation and an average price target of $10.74, its upside potential of 60.06% is second only to one: the only decliner in the pack, Cresco Labs. With a Moderate Buy rating and an average price target of $3.49, Cresco Labs stock offers investors a 62.7% upside potential.