Monday turned out to be ruthless for cannabis stocks as they tanked significantly on multiple reports that the Secure and Fair Enforcement (SAFE) Banking Act was excluded from a must-pass federal spending package. This Act aims to prevent federal regulators from penalizing banks and other financial institutions for offering services to legal cannabis businesses. Stocks of U.S. multi-state cannabis operators Cresco Labs (CRLBF), Trulieve Cannabis (TCNFF), Curaleaf (CURLF), and Green Thumb (GTBIF) plunged 17.6%, 17.5%, 16.7%, and 12.1% respectively, on Monday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meanwhile, the U.S.-listed shares of Canadian cannabis companies Canopy Growth (CGC), Tilray (TLRY), and SNDL (formerly called Sundial Growers) (SNDL) fell 7.3%, 8.6%, and 9.7%, respectively. Marijuana remains illegal at the federal level even as more and more U.S. states are legalizing it for recreational and medical purposes. Marijuana’s illegal status makes it difficult for legal cannabis companies to gain access to funds to support their operations and growth initiatives.

As per Bloomberg, this was the third failed attempt in 2022 to get the SAFE Banking Act passed with a larger package. This time the efforts of Senate sponsors, Oregon Democrat Jeff Merkley and Montana Republican Steve Daines, to include the SAFE Banking Act in the $1.7 trillion funding package went in vain. Senate majority leader Chuck Schumer also tried to insert the cannabis banking reform into the omnibus spending bill.

Cannabis stocks have plunged significantly this year as the lack of favorable reforms and the delay in the legalization of cannabis at the federal level have impacted investors’ interest in this sector. President Biden’s decision to pardon all federal offenses related to “simple possession of marijuana” revived some interest in the sector in early October.

Despite the delay in federal legalization of marijuana, Wall Street remains bullish on certain U.S. multi-state cannabis operators. Let’s take a look at three such companies.

Green Thumb (GTBIF)

Green Thumb operates the rapidly growing retail cannabis stores called RISE. The Illinois-based cannabis company has 17 manufacturing facilities, 77 open retail locations, and operations in 15 U.S. markets.

The Street’s Strong Buy consensus rating for Green Thumb stock is based on nine unanimous Buys. The average GTBIF stock price target of $21.31 implies nearly 147% upside potential. Shares have declined 62% year-to-date.

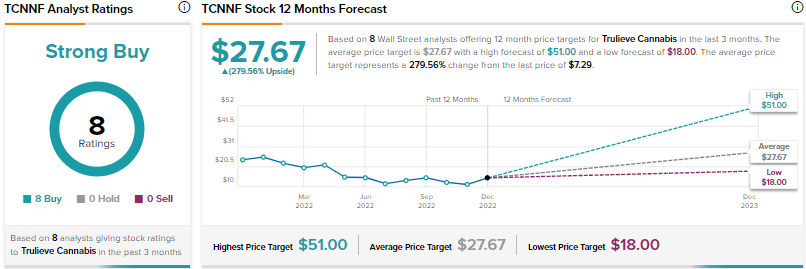

Trulieve Cannabis (TCNNF)

Trulieve Cannabis operates 180 dispensaries and has a leading retail presence in Arizona, Florida, Pennsylvania, and West Virginia.

On TipRanks, Trulieve scores a Strong Buy consensus rating based on eight unanimous Buys. At $27.67, the average stock price target suggests 279.6% upside potential. TCNNF stock has fallen about 73% so far this year.

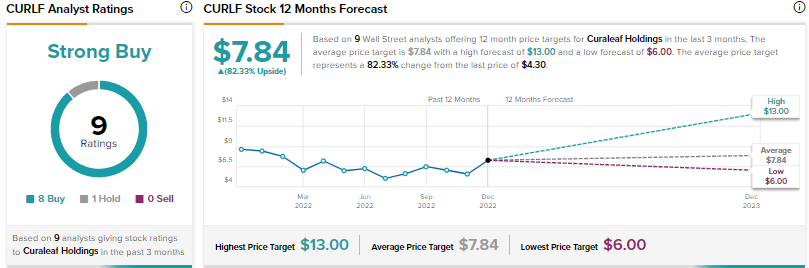

Curaleaf Holdings (CURLF)

Curaleaf operates in 21 states with 144 dispensaries and 29 cultivation sites in the U.S. The company also has the largest vertically integrated cannabis operations in Europe.

Curaleaf scores the Street’s Strong Buy consensus rating, backed by eight Buys and one Hold. The average CURLF stock price target of $7.84 implies 82.3% upside potential. Shares have declined nearly 52% year-to-date.