Manufacturer of solar photo voltaic modules, Canadian Solar (NASDAQ:CSIQ) tanked in pre-market trading as its Q3 results left investors disappointed. The company’s earnings declined by 71.4% year-over-year to $0.32 per diluted share and were below analysts’ expectations of $0.82 per share.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company’s net revenues declined by 4% year-over-year to $1.8 billion, again missing consensus estimates of $2.03 billion. Canadian Solar’s total module shipments recognized as revenues in the third quarter were 8.3 Giga Watt (GW), up by 39% year-over-year. Out of these total module shipments, 82 Mega Watt (MW) were shipped to the company’s own utility-scale solar power projects.

More importantly, Canadian Solar’s utility-scale battery energy storage platform. e-STORAGE signed new bookings worth $520 million, including contractual long-term service agreements between June 30 and November 14. As of November 14, the company’s backlog, including contractual long-term service agreements, was $2.6 billion.

Looking forward, management now expects total revenues in the fourth quarter to be in the range of $1.6 billion to $1.8 billion. In FY24, the company anticipates total module shipments to be in the range of 42 GW to 47 GW

Is CSIQ Stock a Good Buy?

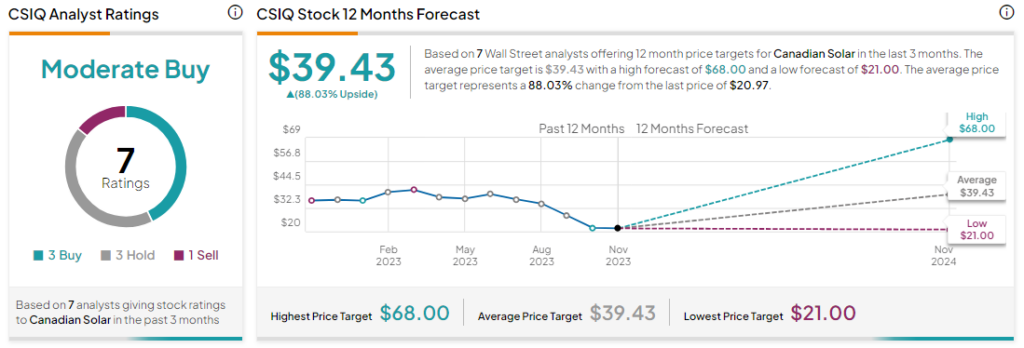

Turning to Wall Street, analysts are cautiously optimistic about CSIQ stock based on three Buys and three Holds each and one Sell assigned in the past three months, as indicated by the graphic below. The CSIQ stock has slid by more than 40% in the past year and the average CSIQ price target of $39.43 per share implies an 88% upside potential.