While much of the world’s attention is focused on New York City, where truckers have reportedly become embroiled in delivery shutdowns, a look at Canada reveals they may not be alone. Railroad companies Canadian Pacific (TSE:CP) (NYSE:CP) and Canadian National Railway (TSE:CNR) (NYSE:CNI) both find themselves facing a potential calamity in the making. The latest reports noted that the union that represents 9,300 workers at the two rail lines revealed that contract negotiations have come to a standstill, with “CN and CPKC (Canadian Pacific Kansas City) aim(ing) to eliminate all safety-critical rest provisions from our collective agreements.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That sounds like bad news, and it got worse. Francois Laporte, Teamsters Canada president, noted, “These provisions are necessary to combat crew fatigue and ensure public safety.” With these rest provisions apparently now in jeopardy, so too is continued work out of the union. A work stoppage is now in the cards and may hit as soon as May.

But Is It All Bad News?

Canadian National, for its part, notes that the rest provisions are making it harder to crew trains, particularly in conjunction with new changes from regulators. Canadian Pacific Kansas City noted that it’s offered a wide range of new incentives but that the railway and the union are “…far apart on the issues.” Meanwhile, Canadian National has grown its earnings per share (EPS) figures by 21% per year for the last three years, a development that’s hard not to like. But without rail workers, how long can Canadian National keep that kind of growth rate up?

Which Is the Better Buy, CNR or CP?

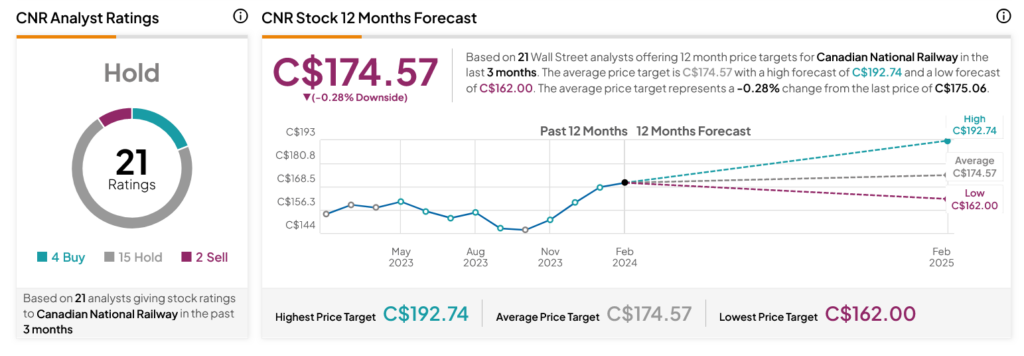

Turning to Wall Street, both stocks offer downside risk right now. CNR stock, rated a Hold by analysts, offers a 0.28% downside risk against its average price target of C$174.57. Meanwhile, CP stock, a Moderate Buy, offers a 0.34% downside risk against its average price target of C$114.80 per share.