After market close today, Canadian National Railway (TSE:CNR) (NYSE:CNI) reported robust financial results for Q1 2023, which beat both revenue and earnings-per-share (EPS) expectations. Also, due to its continued strength, CNR raised its guidance for 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For Q1 2023, the firm reported record Q1 diluted earnings per share of C$1.82, up by 38% on an adjusted basis, beating the C$1.72 consensus estimate. CNR also posted record Q1 revenues of C$4.313 billion (vs. estimates of C$4.254 billion), a 16% increase compared to Q1 2022. The revenue growth was primarily fueled by increased fuel surcharge revenue, rising freight rates, and greater Canadian grain export volumes, although it was partially counterbalanced by reduced intermodal volumes.

Additionally, operating income came in at a Q1 record of C$1.662 billion, 35% higher year-over-year. Further, CNR’s operating ratio (operating expenses divided by revenues) improved by 5.1 points on an adjusted basis to 61.5%, and the company generated free cash flow of C$593 million, up 4%.

Following strong Q1 results, CNR now expects to deliver adjusted diluted EPS growth in the mid-single digits this year compared to 2022, up from its previous target of low-single digits.

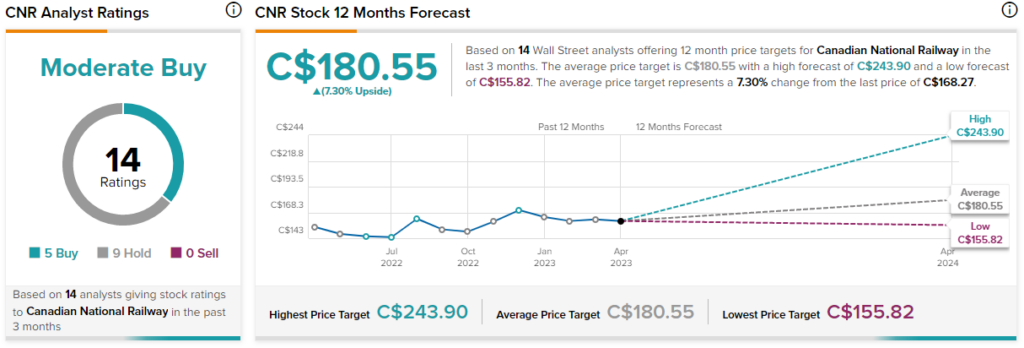

Is CNR Stock a Buy, According to Analysts?

According to analysts, Canadian National Rail stock comes in as a Moderate Buy. That’s based on five Buys and nine Holds assigned in the past three months. The average CNR stock price target of C$180.55 implies 7.3% upside potential.