After market close today, Canadian National Railway (TSE: CNR) (NYSE: CNI) reported its Q3-2022 financial results, which beat both revenue and earnings-per-share (EPS) expectations. In addition, the company raised its guidance for the full year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CNR’s revenue reached C$4.51 billion compared to the consensus estimate of about C$4.33 billion, representing a 26% growth rate. The high growth can be attributed to rising fuel surcharge revenue and FX tailwinds from a weakening Canadian dollar. In addition, CNR’s adjusted diluted earnings per share were C$2.13, up 40% year-over-year, while analysts were expecting a figure of C$2.01. This is a quarterly record for the company.

Adjusted operating income rose a bit less than adjusted EPS, registering a 31% gain, and free cash flow reached C$2.92 billion on a trailing-nine-months basis, growing by a whopping ~43.8%. Further, CNR’s adjusted operating ratio (operating expenses divided by revenues) improved by 1.8 points, hitting 57.2%.

Canadian National Railway Boosts Its 2022 Outlook

In addition to its solid results, CNR boosted its guidance. The company expects adjusted diluted EPS to grow by 25% for the year compared to its previous outlook of 15%-20% growth. Also, its free cash flow is expected to come in at C$4.2 billion compared to the previous range of C$3.7 billion to C$4.0 billion. In line with previous expectations, CNR expects an operating ratio under 60% and a return on invested capital of about 15%.

Is CNR Stock a Buy, According to Analysts?

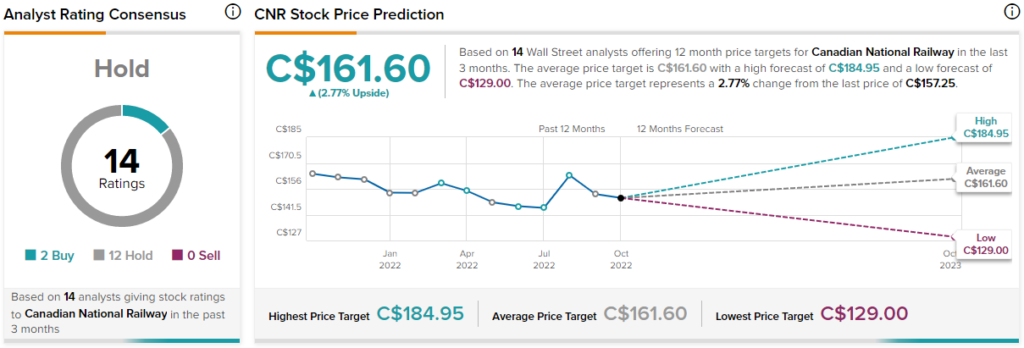

Turning to Wall Street, Canadian National Rail stock comes in as a Hold. That’s based on two Buys and 12 Holds assigned in the past three months. The average CNR stock price target of C$161.60 implies 2.8% upside potential.

Conclusion: CNR’s Q3-2022 Results Come in Strong

Canadian National Railway beat both revenue and EPS expectations while increasing guidance for the full year. That’s a triple win. However, with CNR stock flat on the year compared to the overall market, which is down substantially, it may not have much room for upside. This is evidenced by analyst price targets, which imply little upside. Nonetheless, the stock’s resilience is impressive.