Cinema chain Cineplex (TSE:CGX) is being sued by Canada’s competition regulator for reportedly deceiving customers with deceitful pricing practices. The Competition Bureau claims that Cineplex is violating the law by including an additional online booking fee, effectively increasing the cost of movie tickets. The issue is that this is considered a form of “drip pricing” — advertising a product at a certain price but then adding a mandatory fee during the buying process.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Cineplex has been doing this for almost a year, apparently creating lots of sales for the firm. However, it’s regarded as misleading under recent amendments to the Competition Act.

Matthew Boswell, the Commissioner of Competition, criticized the company’s pricing strategies, saying, “Misleading tactics like drip pricing only serve to deceive and harm consumers.” The Bureau wants to make Cineplex halt misleading advertising, pay a fine, and offer compensation to the affected consumers.

Is Cineplex Stock a Buy, According to Analysts?

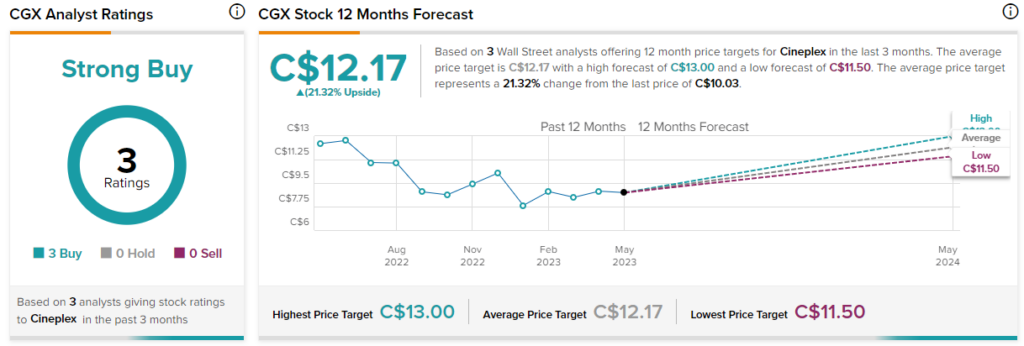

According to analysts, CGX stock comes in as a Strong Buy based on three Buys assigned in the past three months. The average CGX stock price target of C$12.17 implies 21.3% upside potential.