It seems like Alphabet’s (GOOGL) legal issues keep piling on as Canada’s Competition Bureau is now suing Google over anti-competitive practices in the online advertising market. The bureau has asked the Competition Tribunal to order Google to sell two of its ad tech tools and impose a penalty to ensure compliance with competition laws. Unsurprisingly, the search engine giant denied the claims. It argued that the ad market is highly competitive and that its tools help fund content and support businesses of all sizes.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, the bureau began investigating Google in 2020 and expanded its probe this year to include its advertising technology services. It claims Google has abused its dominant position in Canada’s ad tech market to maintain its power. The case mirrors the U.S. Justice Department’s efforts to prove Google monopolized ad markets, with closing arguments in that case made earlier this week.

Google has consistently pushed back by arguing that regulators in Canada, the U.S., and the EU are ignoring healthy competition and its legitimate business decisions. While Google offered to sell its ad exchange earlier this year to resolve an EU investigation, publishers rejected the proposal. Indeed, they said the move was insufficient.

Google Looks to Overturn a Ruling

Separately, Google recently asked the U.S. appeals court to overturn a ruling that forced it to make major changes to the Google Play Store. Google claimed the trial judge’s decision unfairly favored the plaintiff, Epic Games.

The dispute stems from an antitrust trial last year, where Fortnite creator Epic Games accused Google of monopolizing the app store market and its in-app payment system. In October, Judge James Donato ruled against Google, ordering the company to allow developers to create competing app stores and offer alternative billing options to consumers.

Is Google Stock a Good Buy?

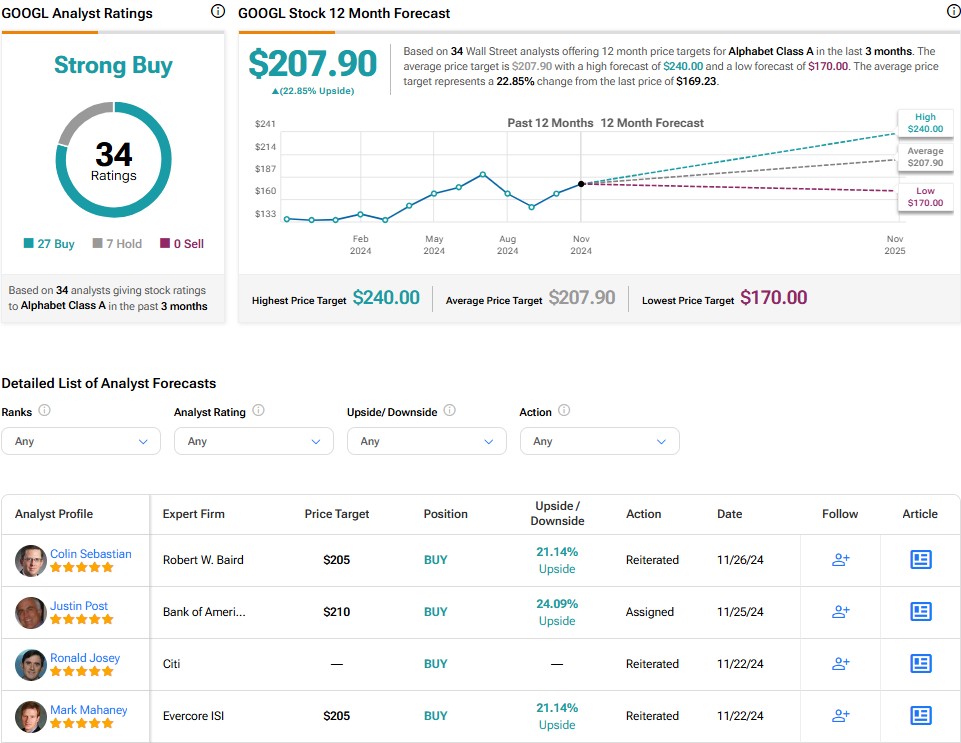

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 27 Buys and seven Holds assigned in the past three months. After a 21% year-to-date gain, the average GOOGL price target of $207.90 per share implies 22.9% upside potential from current levels.