The week was already a forgettable one for Canada Goose (TSE:GOOS) (NYSE:GOOS), as the shares of the extreme weather wear maker saw consecutive selloffs. However, the misery doubled on Thursday after TD Cowen and Wells Fargo made sour predictions for the company and asked investors to move to the sideline for now. Analysts at the firms anticipate strong headwinds due to macroeconomic concerns in China, warmer-than-usual fall weather, and weakening customer trends, which could impact sales. As a result, shares dipped 4.44% on Thursday. In the last three months, the stock has lost 32.92% of its value.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At TD Cowen, analysts downgraded Canada Goose from Hold to Sell while cutting the price target to $15 from $22. The analysts noted concerns about Canada Goose’s business in China, which they said could take a significant hit.

Wells Fargo analysts, led by Ike Boruchow, downgraded Canada Goose from Overweight to Equal-weight (equivalent to a Hold rating). They also slashed its price target from C$25 to C$20. “With a $39 billion addressable market and a predominantly (direct-to-consumer) network, China is seen as one of the core pillars of management’s strategy for reaching their aggressive 2025 investor day targets,” the analysts wrote.

What is the Target Price for GOOS Stock?

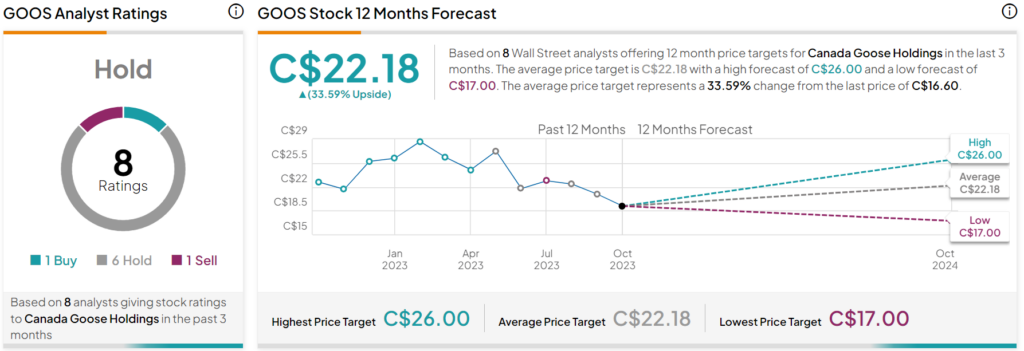

Turning to Wall Street, analysts have a Hold consensus rating on GOOS stock based on one Buy, six Holds, and one Sell assigned in the past three months, as indicated by the graphic above. Furthermore, the average GOOS price target of C$22.18 per share implies 33.6% upside potential.