After market close today, Canaccord Genuity Group (TSE:CF) released its Q4 and full-year Fiscal 2023 earnings results. Adjusted EPS came in at C$0.07, missing the C$0.24 consensus estimate, while revenue reached C$430.39 million, beating the C$397.87 million estimate. Nonetheless, EPS and revenue fell by 86.5% and 13.9% year-over-year, respectively.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Operating expenses for Q4 increased due to heightened general and administrative expenses along with increased market interest rates, which contributed to the fall in earnings.

For the full fiscal year, revenue was C$1.51 billion, down from C$2.05 billion in the prior year, and adjusted EPS fell from C$2.51 to C$0.59. Lastly, the company reported total client assets of $96.2 billion in its Global Wealth Management business, a minor increase of 0.2% from Q4 2022.

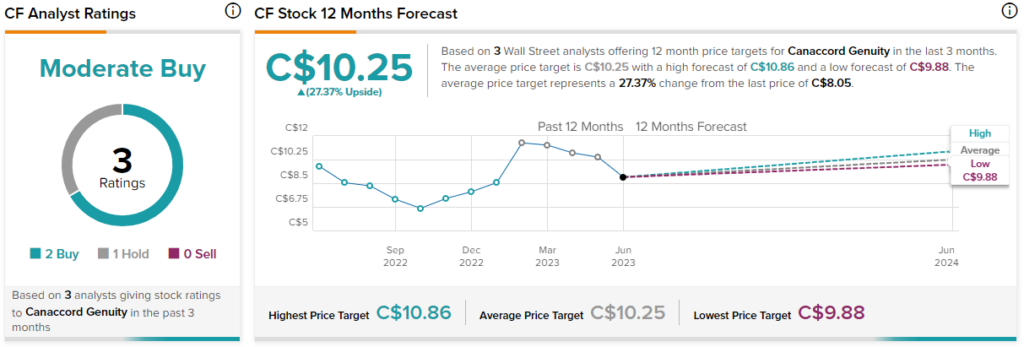

Is Canaccord Genuity Stock a Buy, According to Analysts?

On TipRanks, CF stock comes in as a Moderate Buy based on two Buys and one Hold assigned in the past three months. The average CF stock price target of C$10.25 implies 27.4% upside potential.