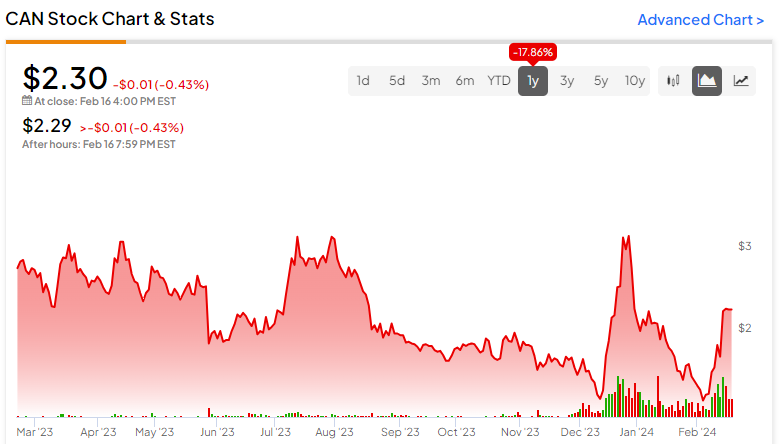

Without question, Bitcoin (BTC-USD) and the cryptocurrency sector have lit up market sentiment. However, directly investing in the space comes with unique challenges. For those interested in cryptos but who don’t want to incur the extracurricular drama tied to the ecosystem, blockchain miner Canaan (NASDAQ:CAN) offers a viable alternative.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Rather than being a virtual currency itself, Canaan provides the hardware necessary to mine Bitcoin. It’s a publicly-traded enterprise like any other, except that it features some fundamental correlation to BTC. Better yet, with CAN stock call options, traders can replicate some of the upside without the unique risks of direct crypto investments. I am bullish on both CAN stock and Bitcoin, owning a position in both.

CAN Stock Stakeholders Eye the “Halving”

Fundamentally, CAN stock presents a tempting proposition because of the upcoming Bitcoin halving event. According to TipRanks contributor Steve Anderson, the halving makes the “amount of Bitcoin that can be derived from a block of code [poised] to decline.” As Anderson states, this dynamic “will make finding new Bitcoin harder, and thus, further limit the amount of Bitcoin available in the system for everybody else.”

Combined with the increased demand for BTC, some analysts have called for price targets of $120,000 per coin. Other prominent voices have even called for a $150,000 Bitcoin price by 2025. It’s difficult to ascertain what the ultimate target will be, given the intense demand and volatility of the crypto space.

To be fair, betting on virtual currencies directly may be the most profitable idea. However, going this route carries tremendous risks. Not only must investors contend with extreme volatility, but certain circumstances that are unique to crypto – such as the devastation of lost passwords locking people out of millions – leave prospective market participants anxious.

To that end, CAN stock may make sense. Yes, it’s risky and tremendously volatile. Still, it’s a publicly-traded security at the end of the day and thus enjoys certain administrative protections tied to this asset category.

Options Roadmap for Canaan

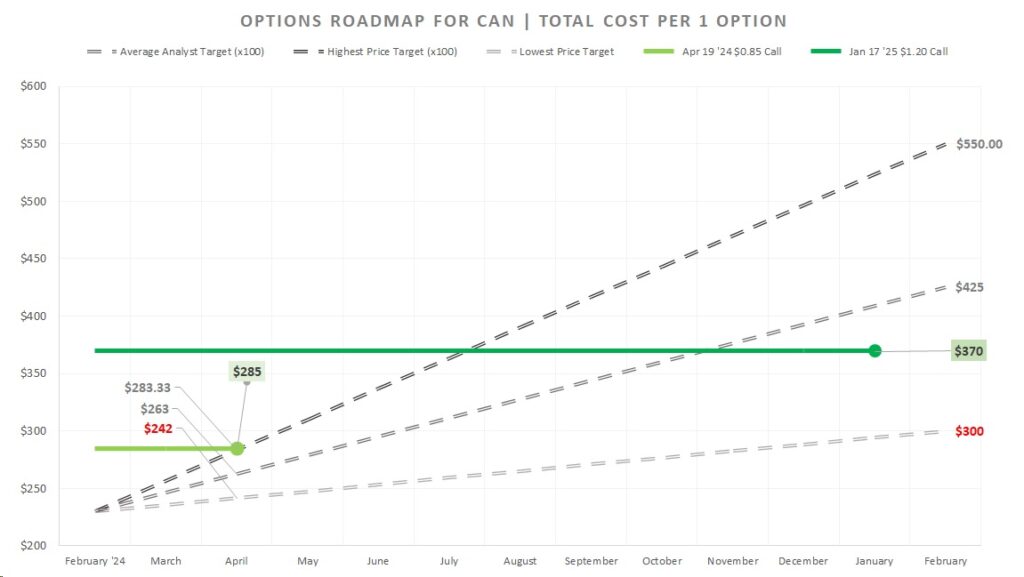

For options speculators, the thesis is that the Bitcoin halving should dramatically lift sentiment for CAN stock. If so, the event – scheduled for April 19 of this year – presents an intriguing opportunity for options traders.

For near-expiry options, the CAN Apr 19 ’24 2.00 Call is attractive for its premium price and perfect timing. Obviously, the idea here is to gamble on the buy-the-rumor, sell-the-news phenomenon. As excitement builds for the halving, you’ll want to be prepared to sell (or exercise) the contract.

Given the immediate volatility following the approval of Bitcoin exchange-traded funds, BTC could likewise stumble following the halving. We want to get ahead of this ebb and flow, selling into euphoria and getting out.

On Friday, the $2 April call closed at 85 cents. Multiplying by 100 shares gives you a total premium of $85. Should you exercise the call, you must buy 100 shares at the $2 strike for a total contract cost of $285.

Admittedly, the tricky part is this: assuming a linear projection of the highest analyst price target of $5.50, CAN stock may only be priced at $2.83 by expiration. Therefore, the value of 100 shares at the projected high-side target would be $283. So, you’d lose two bucks if you were forced to trade only on intrinsic value. Still, the halving may accelerate sentiment, so it’s not an irrational wager.

If you prefer a longer-expiry option, prospective speculators should consider the Jan 17 ’25 2.50 Call. With a premium of $1.20 (total premium of $120), you enjoy the luxury of an expiration date out to early next year. Also, the spread is quite attractive for an option that expires in about 11 months.

Arguably, the biggest takeaway, though, is the total cost of the contract assuming exercise, which comes out to $370. Assuming that the average analysts’ price target holds true, by January, we could be looking at a CAN stock price of $4.09. Stated differently, the position you would have exercising the January call would be worth about $409, yet your cost would be only $370.

To be clear, the profit of $39 doesn’t sound like much, but here are two things to consider. First, you can always buy more of the January calls to level up your exposure (although, of course, you would be taking on more risk). Second, the idea here is that CAN stock should accelerate higher well before the January 2025 expiration.

If it doesn’t, and CAN merely progresses toward the average target in a linear fashion, you at least won’t lose money.

Risk Factors to Watch

Despite the seemingly straightforward approach to CAN stock options, the framework presents high risks. First, it’s always possible that Bitcoin can collapse. Cryptos don’t hire people or generate earnings. They’re priced at whatever people believe they’re worth. That belief can change in a hurry.

Second, analysts’ price projections – no matter from whom they originate – are, at the end of the day, opinions. Absolutely no guarantees exist that these targets will materialize. Therefore, you must consider worst-case scenarios before stepping forward.

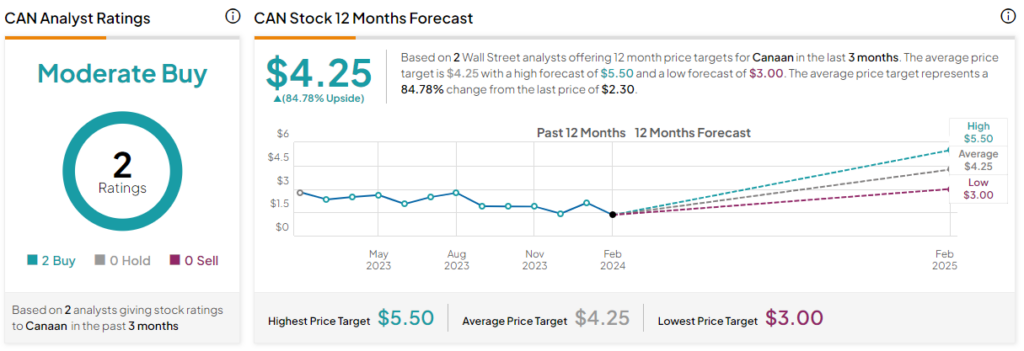

Is CAN Stock a Buy, According to Analysts?

Turning to Wall Street, CAN stock has a Moderate Buy consensus rating based on two Buys, no Holds, and zero Sell ratings. The average CAN stock price target is $4.25, implying 84.78% upside potential.

The Takeaway: CAN Stock Offers Crypto-Like Exposure

While no one will deny the explosive upside potential of the cryptocurrency space, it’s equally undeniable that the ecosystem features unique risks. With that, some investors may feel more comfortable betting on major crypto events like the upcoming halving with CAN stock. As a blockchain mining investment, Canaan features some correlation to Bitcoin but without some of the anxiety-inducing drama.