It has been an inauspicious start to the year for EV stocks with most already taking a sound beating. You can add Vietnamese EV maker VinFast Auto (NASDAQ:VFS) to that list, whose shares shed 31% year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

VinFast’s recent Q4 earnings revealed both positive and concerning aspects. Total revenue in the quarter hit $436.5 million, marking a significant 133% year-over-year increase and a 36% sequential improvement. However, the figure fell short of the Street’s forecast of $526.3 million, primarily attributed to the challenging high-interest-rate environment. Additionally, the gross margin came in at (40.1%), indicating a considerable decline from the previous period’s (29.9%), mainly due to the company’s one-time NRV inventory adjustment. Consequently, the pro-forma EPS stood at ($0.28), which was worse than both the Street’s estimate of ($0.23) and the previous quarter’s ($0.27).

Elsewhere, during the quarter, the company added ~100,000 charging points across different markets, bringing its total charging points across the globe to 800,000 points. And looking ahead, the company aims to produce 150,000 vehicles in 2024 while delivering 100,000 units. About half of these are expected to be in Vietnam and the rest international as the company embarks on a new stage of growth and expands its worldwide network of dealerships. By 2025, VinFast anticipates achieving positive gross margins, while aiming to reduce its BOM (bill of materials) costs by 40% over the next two years with each new product launch.

For Wedbush’s Daniel Ives, a 5-star analyst rated in the top 5% of the Street’s stock pros, the fact VinFast missed on both the top-and bottom-lines is not that much of a big deal. “Most importantly,” Ives says, the company provided strong FY24 guidance as the company doubles down on its current initiatives to capitalize on current EV demand globally with governments globally pushing for the electrification of fleets.”

“With over $1.8 billion in liquidity and strong backing from parent company VinGroup, we believe that 2024 will be a key year for VFS to ramp its production to deliver its product portfolio to its consumers while improving its overall cost structure to reach positive EBITDA by 2025 and positive FCF by 2027,” the top analyst summed up.

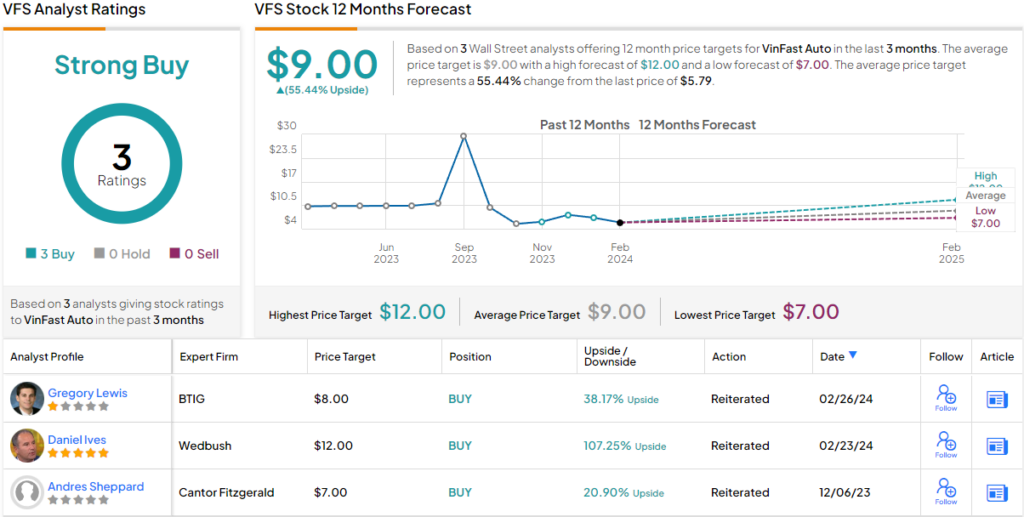

Accordingly, Ives rates VFS an Outperform (i.e., Buy) to go alongside a Street-high $12 price target. The implication for investors? Upside of a big 107% from current levels. (To watch Ives’ track record, click here)

Only two other analysts have recently waded in with VFS reviews, but like Ives, both are positive, providing the stock with a Strong Buy consensus rating. The forecast calls for 12-month returns of ~55%, considering the average price target stands at $9. (See VinFast stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.