Rigetti Computing (RGTI) has captured investors’ attention with an astonishing 92% surge in its stock over the past month. The quantum computing company is riding a wave of market enthusiasm. But amid the excitement, many investors are worried about the stock’s future upside potential. The rapid rally has pushed RGTI into overbought territory and even surpassed the analysts’ average price target, making near-term gains uncertain. However, in the long term, analysts remain bullish on the company’s continued progress in quantum computing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, Rigetti is focused on developing superconducting qubits and scalable quantum hardware for commercial and research applications.

What’s Happening with RGTI Stock?

Over the past six months, RGTI stock has surged more than 190%, driven by the company’s technological breakthroughs. In the pre-market hours on Monday, RGTI stock has declined over 5%.

Last month, alongside its Q2 results, Rigetti unveiled its multi-chip quantum computer, Cepheus-1-36Q, which has significantly reduced two-qubit gate errors and improved fidelity, strengthening its position in scalable quantum computing.

Most recently, RGTI shares jumped last week after the company announced a $5.8 million, three-year contract with the U.S. Air Force Research Laboratory. As part of the deal, Rigetti will partner with Dutch quantum hardware maker QphoX to advance superconducting quantum networking.

What’s Next for Investors?

Looking ahead, the company aims to build a 100-qubit system by the end of 2025 and expand to over 1,000 qubits within four years. This could position Rigetti as one of the few pure-play quantum companies on a path to error-corrected computing.

Additionally, Rigetti’s cash position is strong following a $350 million equity raise in June. The company now has $571.6 million in cash and equivalents and carries no debt as of June 30, 2025.

For investors interested in the long-term potential of quantum computing, RGTI is a high-risk, high-reward stock. With strong cash reserves and support from multiple contracts, the stock could keep rising, but given its high current valuation, it’s reasonable to hold until the company delivers on its ambitious plans.

What Is the Target Price for RGTI Stock?

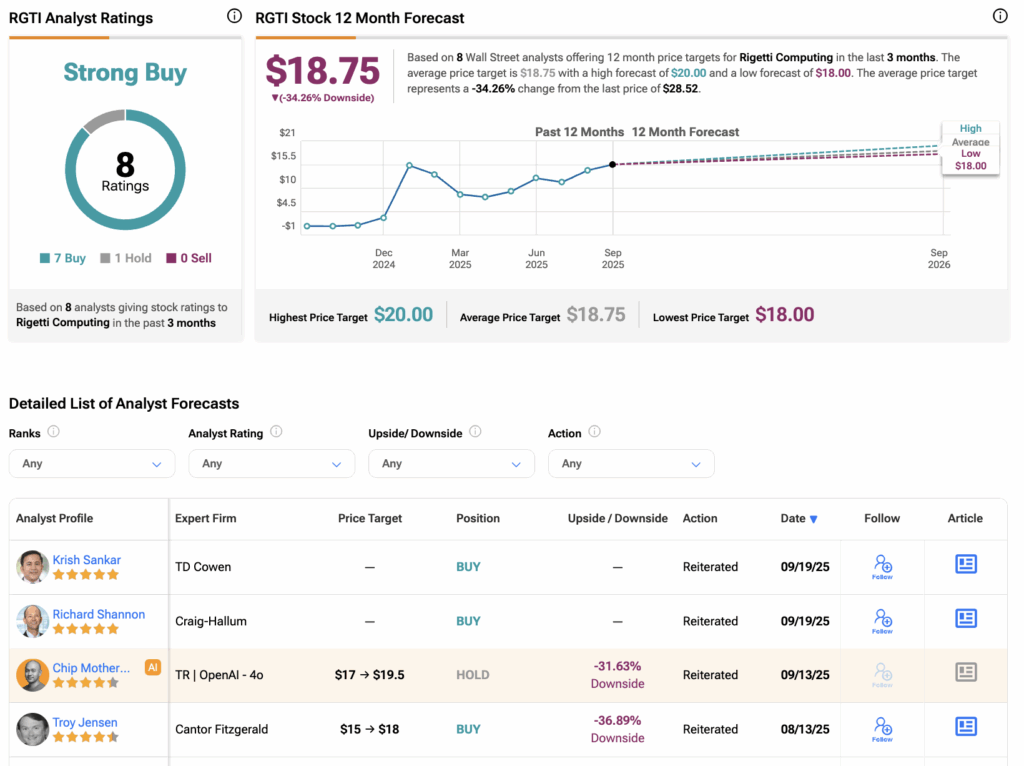

According to TipRanks, RGTI stock has received a Strong Buy consensus rating, with seven Buys and one Hold assigned in the last three months. The average stock price target for Rigetti Computing is $18.75, suggesting a potential downside of 34.26% from the current level.