Meta Platforms (NASDAQ:META) stock has been on an absolute tear in the last 15 months. After losing over 70% during the bear market two years back, META stock has risen 390% since November 2022, allowing the social media giant to reclaim its trillion-dollar valuation. Despite its gains, I’m bullish on Meta due to its efforts to optimize costs, investments in disruptive verticals such as the Metaverse and AI, and widening earnings base. So, let’s see why Meta is positioned to deliver market-beating gains in 2024 and beyond.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Social Media Behemoth

Meta is the largest social media company in the world, owning platforms such as Facebook, WhatsApp, Messenger, and Instagram. Launched in 2004, Meta has changed the way people connect all around the world. Now, it aims to move beyond the traditional 2D screens towards immersive experiences such as augmented, virtual, and mixed reality.

How Did Meta Perform Q4 2023?

Meta reported revenue of $40.11 billion in Q4 2023, an increase of 25% year-over-year. Its earnings more than tripled to $14 billion or $5.33 per share. Comparatively, analysts forecast Meta to report revenue of $39.18 billion and earnings of $4.96 per share in the December quarter.

The firm ended 2023 with 3.07 billion Facebook monthly active users and 2.11 billion Facebook daily active users, showcasing the massive scale at which it operates.

Meta’s ad impressions across its family of apps rose by 21%, while the average price per ad increased by 2%, resulting in stellar growth in its top line.

The company’s focus on cost optimization allowed it to decrease total expenses by 8% to $23.73 billion in Q4 2023. Meta continues to invest heavily in capital expenditures, spending close to $8 billion in the December quarter and $28 billion in 2023.

Generally, investing in capital expenditures should drive future cash flows and earnings higher. Here, a company allocates capital to build new products or services, which may allow it to enter new markets and gain traction in existing ones. Over the years, Meta has spent heavily in research and development to successfully engage a rapidly expanding audience base across social media platforms.

What Will Drive Expenses for Meta in 2024?

In Q1 2024, Meta expects sales to range between $34.5 billion and $37 billion, higher than the consensus estimate of $33.8 billion. Meta’s total expenses in 2024 are estimated to range between $94 billion and $99 billion due to higher infrastructure-related costs.

Moreover, Meta’s increased capital investments in recent years will lead to higher depreciation expenses in 2024. It also expects to incur an uptick in operating costs due to higher payroll expenses as it adds incremental talent to support key growth areas in 2024.

Meta expects Reality Labs to be a key driver of revenue growth in the upcoming decade. In Q4 2023, Reality Labs’ revenue stood at $1.07 billion, up from $727 billion in the year-ago period. However, total expenses for this segment increased from $4.27 billion to $4.64 billion in the last 12 months. The tech behemoth emphasized that it expects operating losses for Reality Labs to increase meaningfully in 2024 due to product development efforts in augmented and virtual reality.

Meta is positioned to benefit from an early mover advantage in verticals such as Metaverse, given its aggressive push in the Reality Labs business. According to a Statista report, the Metaverse market might touch $936 billion by 2030, up from $65.5 billion in 2022. So, if Meta can gain a 10% share in the Metaverse market, it would add close to $100 billion in sales in 2030.

Meta anticipates ending 2024 with total capital expenditures between $30 billion and $37 billion, which is a $2 billion increase at the high end of its prior range.

Meta also expects that CapEx growth will be driven by investments in servers for its artificial intelligence (AI) and non-AI hardware and data centers as it aims to compete with other tech giants in this highly disruptive segment.

During the company’s Q4 earnings release, Meta stated, “Our updated outlook reflects our evolving understanding of our artificial intelligence (AI) capacity demands as we anticipate what we may need for the next generations of foundational research and product development.”

Meta Announces a Quarterly Dividend

Meta surprised Wall Street by announcing a quarterly dividend of $0.50 per share, indicating a forward yield of 0.43%. Given its total outstanding share count, Meta will distribute $4.4 billion to shareholders via dividends in 2024.

In 2023, Meta reported a free cash flow of $43 billion, which suggests its payout ratio is around 10%, providing it with enough room to reinvest in capital projects, strengthen its balance sheet, and raise dividends further.

Meta ended 2023 with $65.4 billion in cash and $18.4 billion in long-term debt, providing it with enough liquidity to navigate an uncertain environment.

What Is the Target Price for META Stock?

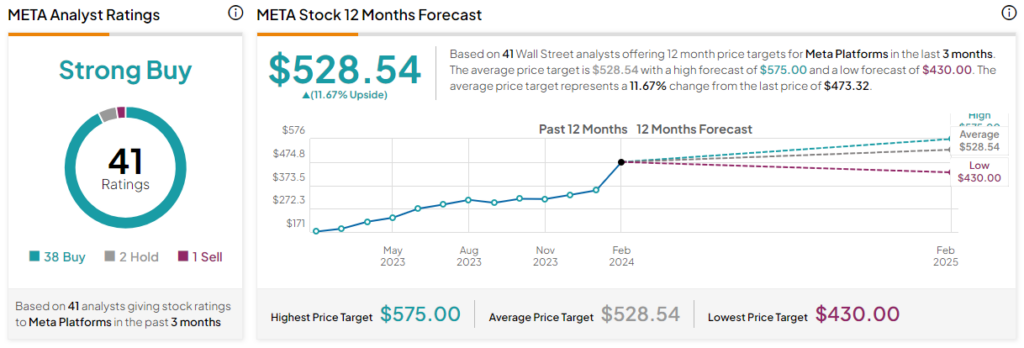

Out of the 41 analysts covering META stock, 38 recommend a Buy, two recommend a Hold, and one recommends a Sell, giving it a Strong Buy consensus rating. The average META stock price target is $528.54, 11.7% above the current price.

Analysts tracking Meta expect its adjusted earnings to grow to $19.93 per share in 2024 and $22.78 per share in 2025. So, META stock is priced at 23.7x forward earnings, which might seem expensive given that the sector PE median is far lower at 15.4x. However, Meta continues to grow at an enviable rate and commands a premium valuation.

The Takeaway

The last year was a pivotal one for Meta, as it improved operating discipline while delivering across product segments and improving ad performance for businesses who rely on its services. It will look to build on its progress in each of these areas in 2024 while advancing its efforts in AI and Reality Labs. These factors can help the stock maintain its momentum.