Intel (NASDAQ:INTC) stock was on the comeback trail in 2023. Boosted by improving fundamentals and the company making progress towards achieving its roadmap targets, the chip giant appears to have moved beyond the serious setbacks such as delays and poor product decisions that have plagued it during recent years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to Tigress Financial’s Ivan Feinseth, a 5-star analyst rated in the top 4% of the Street’s stock pros, there is also some good news regarding the company’s outlook, which appears to be favorable.

“INTC is well-positioned to benefit from the ongoing recovery in PC sales, its leading position in Data Center processors, and the ongoing ramp-up of its foundry capabilities, along with significant growth in AI integration, driving the need for increasing processing power and silicon solutions that optimize performance cost and security across the enterprise including Cloud, Edge, and Client computing,” Feinseth opined.

At its AI Everywhere event in December, the company introduced its new AI-enabled server and PC processors. Intel’s revamped lineup features an enhanced Xeon server processor designed to consume less power while enhancing performance and memory capabilities. Additionally, the firm unveiled its latest Meteor Lake Core Ultra processor family, marking the debut of Intel 4 process technology and showcasing the company’s notable architectural shift, with the product set to be its most power-efficient client processor to-date.

By 2028, it is anticipated that AI-powered personal computers (AI PCs) will dominate the PC market, constituting 80% of the total share. Intel’s 5th Gen Intel Xeon processor family, named Emerald Rapids, incorporates AI acceleration in each core. This is aimed at substantially enhancing both AI-specific tasks and overall performance, all while reducing the total cost of ownership.

With a potential industry TAM (total addressable market) of more than $1 trillion by 2030, Feinseth believes Intel is well-positioned to benefit from “ongoing AI adoption across the computing industry continuum” and stands to reap the benefits of AI PC integration, TCO (Clock to Output Delay) leadership driven by its Gaudi3 chip. Notably, Gaudi3 is the inaugural deep learning (DL) training processor featuring integrated RDMA over Converged Ethernet (RoCE v2) engines on-chip, boasting bi-directional throughput of up to 2 terabits per second.

“These engines play a critical role in the inter-processor communication needed during the training process for its industry-leading Xeon processors,” Feinseth explained.

Moreover, with recently announced plans to spend $25 billion on a new processor manufacturing facility in Israel following an Israeli government grant of $3.2 billion, Intel “continues to invest in expanding the production capabilities of IFS (Intel Foundry Services).”

Bottom-line, Feinseth reiterated a Buy rating on INTC while raising the price target from $46 to $66, suggesting the stock will climb 39% higher in the months ahead. (To watch Feinseth’s track record, click here)

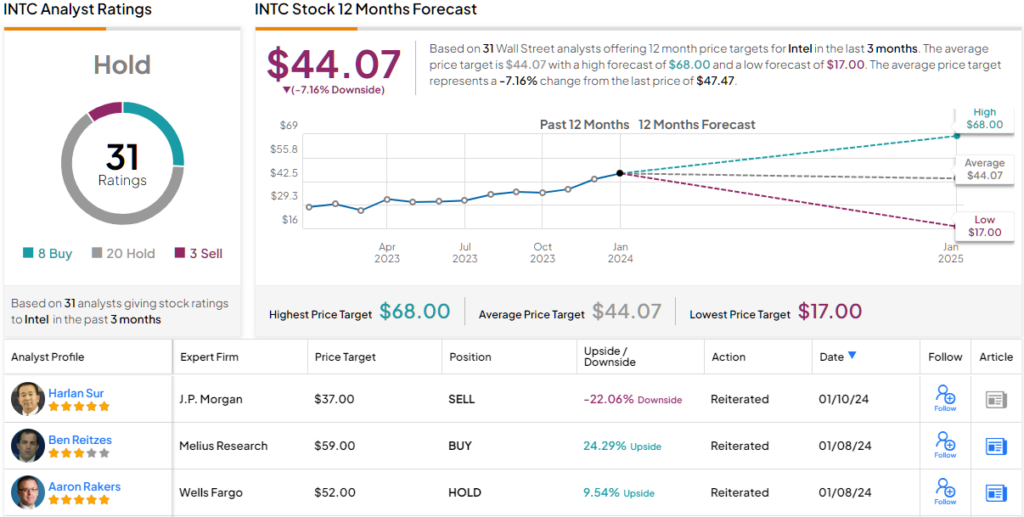

Feinseth’s take, however, is one of the Street’s more optimistic ones. Elsewhere, the stock receives an additional 7 Buys, 20 Holds and 3 Sells, all for a Hold consensus rating. At $44.07, the average target represents downside of 7% from current levels. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.