It’s been almost a month since the U.S. federal government shutdown due to partisan disagreements over funding for the fiscal year 2026, which began on October 1. Amid the shutdown, which is still creating ripple effects across several American industries, airline stocks have managed to stay afloat. But will they be able to keep it up?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What Is the Immediate Impact of the Shutdown?

The impact of the shutdown is immediately apparent: over 8400 flights within, into, or out of the U.S. faced delays on Sunday, October 26, according to flight tracking and data platform FlightAware. This is due to the higher-than-usual delays caused by air traffic controllers calling in sick, leaving few workers to handle their critical duties.

This is even as the shutdown means that controllers, transportation officers, and security screeners hired by the U.S. Federal Aviation Administration have to work without pay, for as long as the shutdown persists.

How Have Airline Stocks Responded So Far?

Airline stocks have shown resilience despite the disruption. As of Friday, the NYSE Arca Airline Index — which tracks the stock prices of major U.S. airlines such as American Airlines (AAL), Delta Air Lines (DAL), and United Airlines (UAL) — rose by 0.99% to reach 63.5380. It surpassed the S&P 500 index, which added 0.79% on the same day.

On October 1, when the shutdown kicked in, the airline index closed at 61.7148. However, data shows the index has maintained its range between 60 and 64 — a sign of volatility and investor caution, but no dramatic shrinkage. Between October 1 and the close of trading on Friday, shares of United Airlines have gained 6.6%, Delta Air Lines’ have risen by 8.6%, and American Airlines Group’s have added 5.1%.

What Do Airlines Expect?

Furthermore, major U.S. airlines have indicated they are positioned to take on the challenges from the shutdown, even as travel demand continues to rise. For instance, United Airlines expects to achieve its highest-ever quarterly revenue by the end of this year. Similarly, American Airlines, which posted record revenue during its Q3, raised its earnings expectations for the next quarter.

Southwest Airlines (LUV) also expects record sales in its current fourth quarter, although the airline trimmed its revenue per available seat mile from about 6% to a range of 1% to 3%. While the U.S. government shutdown is a contributing factor, the downgrade in its guidance is also due to the delay in adding extra legroom seats to its planes.

Analysts expect the impact of the shutdown to cost the airline about $1.5 million a day, compared with less than $1 million a day for Delta Air Lines.

So, What Will Happen Next?

Historically, the airline stocks have always been resilient during troubled periods, as investors take a long-term view of the market. During the last government shutdown between December 2018 and January 2019 — the longest in U.S. history — the airline index outperformed the general market, rising almost 15%, according to U.S. Global Investors (GROW).

However, investors have continued to warn about the potential risk to aviation operations from the shutdown. Chris Sunnu, the head of airline trade group Airlines for America, recently warned that extending the shutdown makes “the risks get higher,” with more air traffic controllers not reporting for their duties.

Furthermore, on October 9, Ed Bastian, Delta Air Lines’ chief executive, told CNBC that the company was operating smoothly despite the shutdown. However, Bastian worried things could change after 10 extra days of impasse.

It’s been 18 days since then, and time will tell how the development will play out for airlines.

What Are the Best Airline Stocks to Buy?

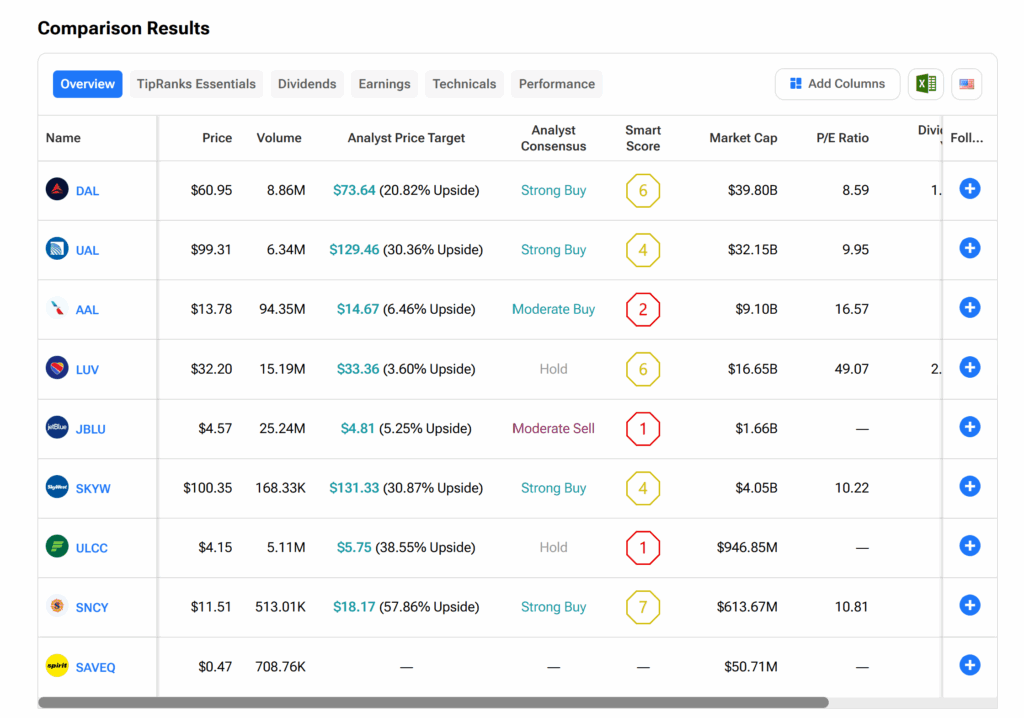

As the shutdown continues, keeping the aviation industry on its toes, determining which airline stocks to buy is critical. This is because the situation still presents an investment opportunity, according to analysts. TipRanks’ Stock Comparison tool provides insight into which stocks are worth buying.

Kindly refer to the graphics below.