Shares of BigBear.ai (BBAI) have surged over 90% year-to-date, fueled by investor excitement around its advanced AI-driven analytics and solutions. However, the key question now is whether BigBear.ai’s fundamentals can support further gains or if the recent rally is largely driven by AI hype. Meanwhile, analysts remain moderately bullish, but much of the near-term growth may already be reflected in the stock price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, BigBear.ai provides data-driven decision intelligence solutions, primarily to the U.S. defense, intelligence, and government sectors.

BigBear.ai Faces Weak Financials

Despite the solid growth in BBAI stock price, BigBear.ai’s revenue is still struggling, and it’s uncertain when the company will become profitable. In Q2, the company reported $32.5 million in revenue, missing the $40.59 million estimate, mainly due to lower activity on certain U.S. Army programs.

Moreover, BigBear.ai is currently unprofitable, prompting questions about its ability to sustain operations over the long term. It also posted an adjusted loss of $0.71 per share, compared with the expected $0.06 loss.

Despite these challenges, CEO Kevin McAleenan emphasized that BigBear.ai is approaching an important moment, supported by the “One Big Beautiful Bill,” which provides $170 billion for Homeland Security and $150 billion for defense technology. These areas match the company’s strengths in national and border security. However, relying heavily on federal contracts carries risks, as changes in government priorities or budgets could impact future deals.

What Lies Ahead for BigBear.ai?

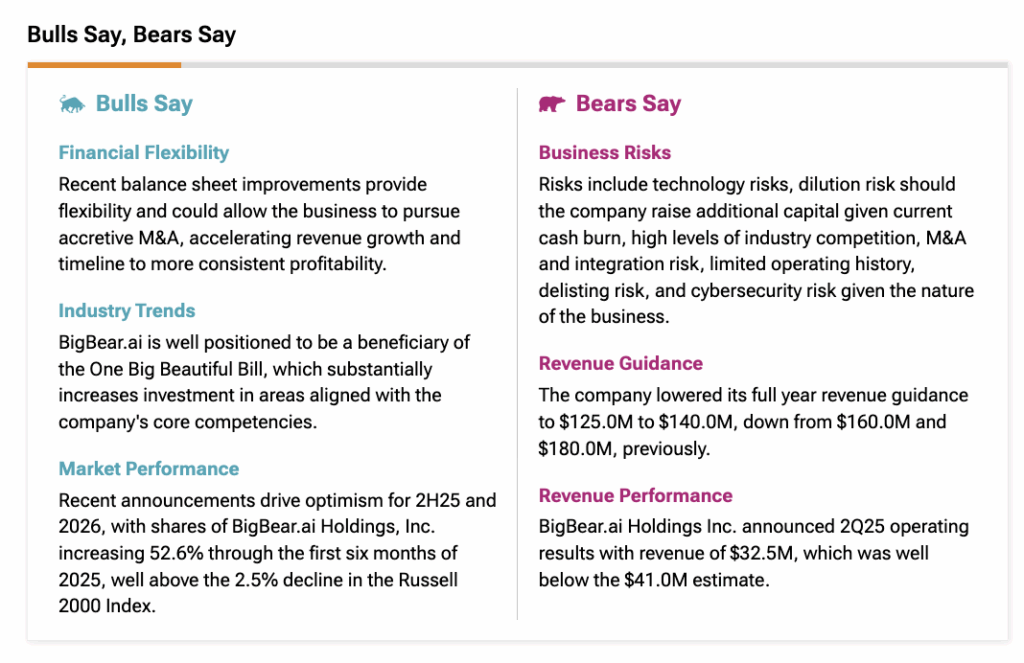

To gauge where a stock might be headed, listening to what analysts are saying is key. Within this context, TipRanks’ Bulls Say, Bears Say tool helps investors by offering a complete snapshot of analyst sentiment, highlighting both the bullish and bearish perspectives.

According to bulls, BigBear.ai’s improved balance sheet gives it financial flexibility to pursue growth-boosting acquisitions, potentially accelerating revenue and profitability. Additionally, the company is well-positioned to benefit from increased government spending under the “One Big Beautiful Bill,” aligning with its core strengths.

On the other hand, the company faces several risks, including technology challenges, intense competition, and financial worries. Looking ahead, the company lowered its full-year revenue guidance to $125–$140 million, down from $160–$180 million.

Is BBAI a Good Stock to Buy?

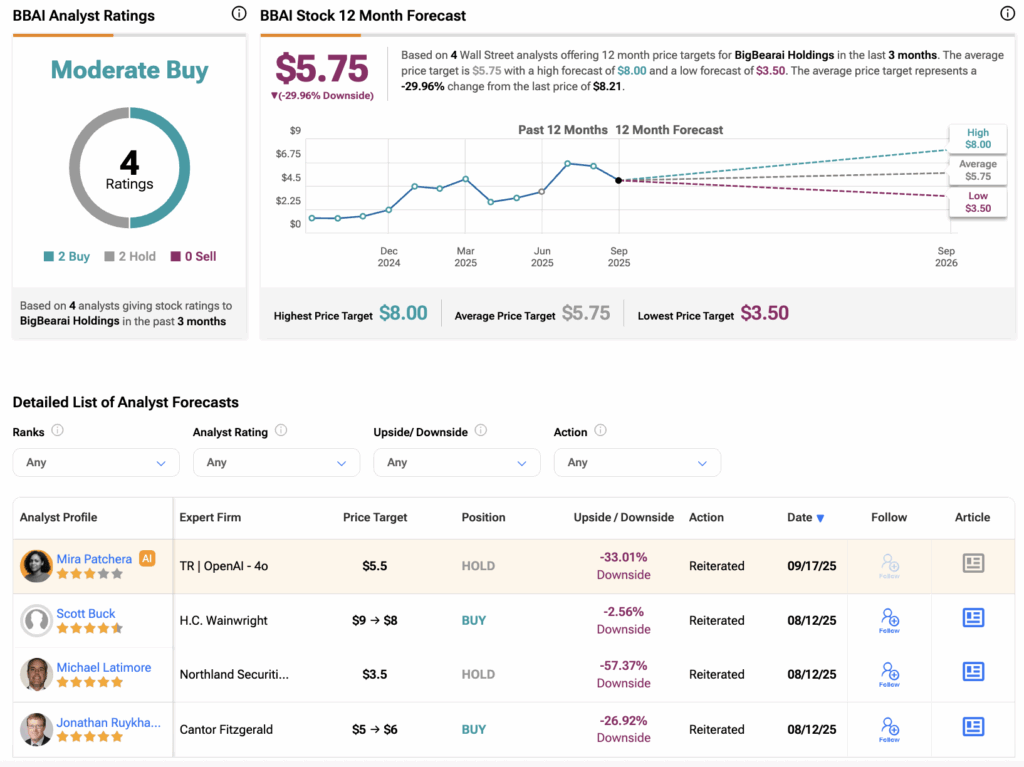

On TipRanks, analysts have a Moderate Buy consensus rating on BBAI stock, based on two Buys and two Holds assigned in the last three months. The average BigBear.ai share price target is $5.75, which implies a downside of 30% from current levels.