Campbell Soup Company (CPB) operates in the foodservice industry in the United States and Canada, manufacturing and marketing food and beverages. It reported Q4 and full-year Fiscal 2021 results on September 1.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fiscal Q4 2021 net sales fell 11% year-over-year to $1.87 billion but came in above the consensus estimate of $1.81 billion. Additionally, adjusted EPS fell 13% to $0.55 but surpassed consensus estimates of $0.47.

For Fiscal 2021, net sales fell 2% year-over-year to $8.48 billion. Adjusted earnings from continuing operations increased 1% to $2.98 a share.

Looking ahead, for Fiscal 2022, Campbell Soup expects net sales to decrease by 2% or remain flat compared to Fiscal 2021. Adjusted EPS, on the other hand, is expected to decline between 8% and 4% compared to Fiscal 2021. (See Campbell Soup stock charts on TipRanks)

“As we head into fiscal 2022, we have robust in-market momentum on our brands, strong plans to manage inflation, and a talented and committed team to lead through what we expect to be a very challenging environment,” said Campbell Soup CEO Mark Clouse.

During the quarter, Campbell Soup paid $439 million in cash dividends to shareholders. Markedly, under the multi-year costs saving program, the company achieved program-to-date savings of $805 million and is on track to deliver $850 million in savings by the end of Fiscal 2022.

The board of directors has also approved a $500 million strategic share repurchase program, adding to the $250 million anti-dilutive share repurchase program announced in the previous quarter.

Yesterday, Stifel Nicolaus analyst Christopher Growe reiterated a Hold rating on the stock. However, Growe lowered the price target to $44 from $48, implying 3.31% upside potential to current levels.

Growe stated, “The sales and profit performance were stronger than expected although its outlook for the coming year, was below our estimate and the consensus estimate due to higher costs, the lag in achieving price realization, and transitional costs, such as the now commonplace supply chain issues, resulting in higher costs. These transitional costs will weigh on FY22 and the company expects steady improvement against these costs (labor mostly) as we move through the year.”

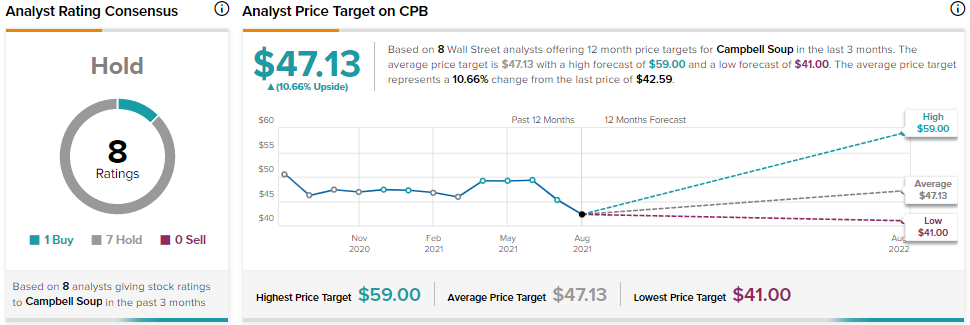

Consensus among analysts is a Hold based on 1 Buy and 7 Holds. The average Campbell Soup price target of $47.13 implies 10.66% upside potential to current levels.

Related News:

American Woodmark Q1 Results Miss Estimates; Shares Plunge 12%

A Look at Unisys’ Earnings and Risk Factors

What Do Royal Gold’s Newly Added Risk Factors Tell Investors?