Shares of Conagra Brands (CAG) rose 2.24% in premarket trading on Wednesday after the food giant reported better-than-expected fiscal Q1 2026 earnings. The company posted adjusted EPS (earnings per share) of $0.39 for the first quarter, topping analyst expectations of $0.33. The Q1 beat came despite persistent inflationary pressures and cautious consumer sentiment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Conagra is a packaged foods company behind popular labels like Birds Eye, Hunt’s, Slim Jim, Healthy Choice, and many more.

More from CAG’s Q1 Results

In the first quarter, sales totaled $2.63 billion, down 5.8% from last year but broadly in line with analysts’ expectations of $2.62 billion. The company has faced supply constraints this year, which particularly affected its frozen meals with chicken and vegetables.

Looking ahead, Conagra reaffirmed its fiscal 2026 guidance, projecting organic net sales growth between -1% and 1%, and adjusted EPS of $1.70–$1.85, consistent with the $1.78 consensus estimate.

Conagra Stays Cautious as Tariffs Keep Costs Elevated

While Conagra’s Q1 results offered some relief to investors, management remains cautious about the year ahead. The company expects higher costs for goods sold to continue through FY26, with core inflation projected slightly above 4%.

Previously announced U.S. tariffs are also expected to have an impact. These tariffs could raise the cost of goods sold by about 3% per year before accounting for actions like faster cost-saving measures, alternative sourcing, and targeted price increases. Overall, the company now expects total cost of goods sold inflation to be in the low 7% range.

Is Conagra Stock a Good Buy?

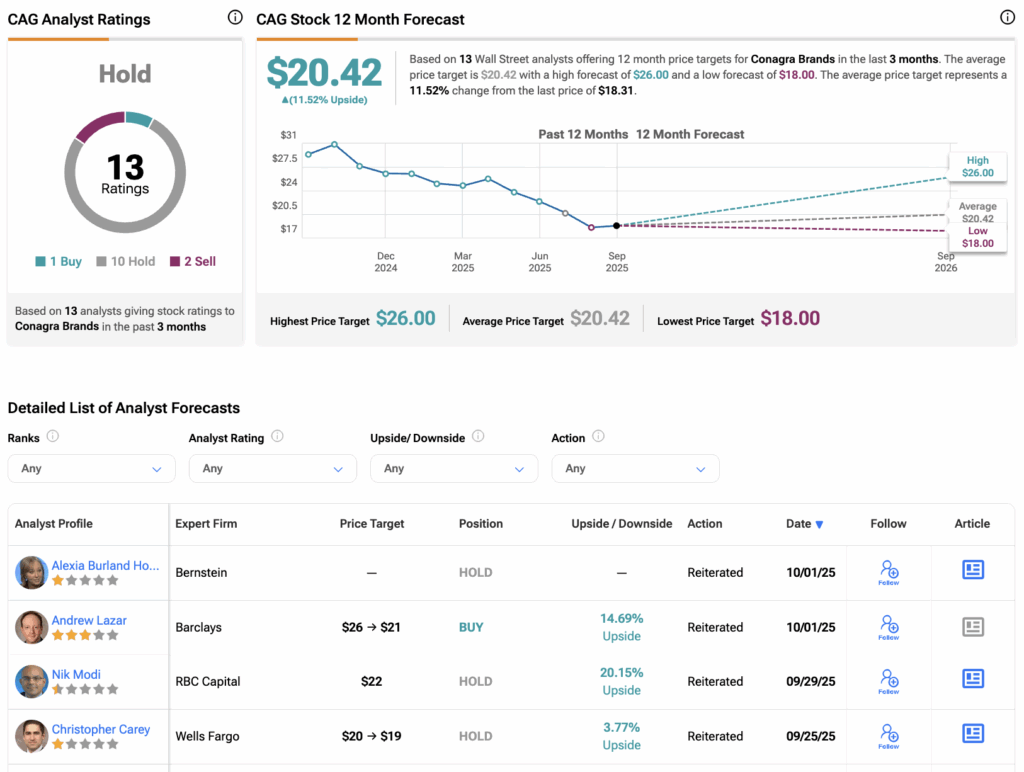

According to TipRanks’ consensus, CAG stock has a Hold consensus rating based on one Buy, 10 Holds, and two Sells assigned in the last three months. At $20.42, the average stock price target of Conagra implies a 11.52% upside potential.