CAE (TSE: CAE) (NYSE: CAE) profit fell in Q3 2022 compared to Q3 2021 despite higher revenues.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CAE is a world leader in modeling, simulation, and training for the civil aviation and defense sectors.

Revenue & Earnings

Revenue came in at C$848.7 million in the third quarter, an increase of 15% from C$832.4 million in the prior-year quarter. Civil aviation training revenue was C$390.1 million, down from C$412.2 million a year earlier. Defense and security revenue rose 42% to C$426.5 million.

Net income attributable to shareholders amounted to C$26.2 million (C$0.08 per share) in Q3 2021, down from a profit of C$48.8 million (C$0.18 per share) in Q3 2020.

On an adjusted basis, CAE earned C$60.7 million (C$0.19 per share) in the third quarter of 2021, compared with an adjusted profit of $60 million ($0.22 per share) a year ago.

CEO Commentary

CAE president and CEO Marc Parent said, “We have been adeptly playing offence during this period of disruption and the long-term outlook for CAE has never looked more attractive. We expect pandemic headwinds to be with us for some time, including ongoing supply chain disruptions, employee and customer absenteeism due to infections, operational constraints by local authorities, and intermittent border restrictions. The current COVID-19 surge has extended the timeline to a broad global recovery, but our performance in the quarter confirms that we are on the path to strong cyclical recovery and secular growth when our markets eventually open and emerge from the pandemic.”

Wall Street’s Take

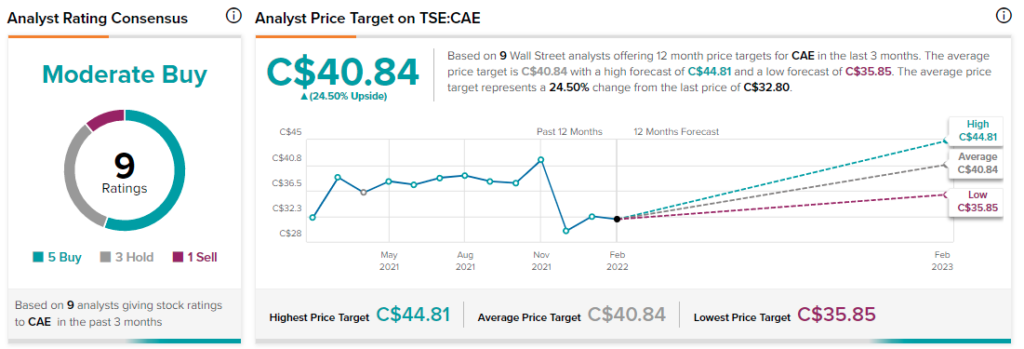

On February 4, Scotiabank analyst Konark Gupta kept a Buy rating on CAE and lowered its price target to C$44 (from C$45). This implies 34.2% upside potential.

Overall, CAE scores a Moderate Buy rating among Wall Street analysts based on five Buys, three Holds, and one Sell. The average CAE price target of C$40.84 implies 24.5% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Bombardier Q4 Revenue Falls 24%

Heroux-Devtek Q3 Sales and Profit Fall

TFI International Q4 Profit Jumps 66%