C3.ai, (NYSE: AI) the artificial intelligence company, was up in pre-market trading at the time of publishing on Monday after it announced preliminary fourth-quarter revenues between $72.1 million and $72.4 million, exceeding the company’s guidance of $71.1 million.

C3.ai anticipates a positive free cash flow in the range of $18.0 million to $19.4 million at the end of Q4 while adjusted loss from operations is likely to widen to a loss between $23.7 million and $23.9 million, exceeding its guidance.

The company stated that the business environment for enterprise AI “seems to be accelerating” with its sales pipeline rising “by over 100% in the past year.” During Q4, the company closed 43 deals, including 19 pilots. AI expects to report its fiscal Q4 results on May 31.

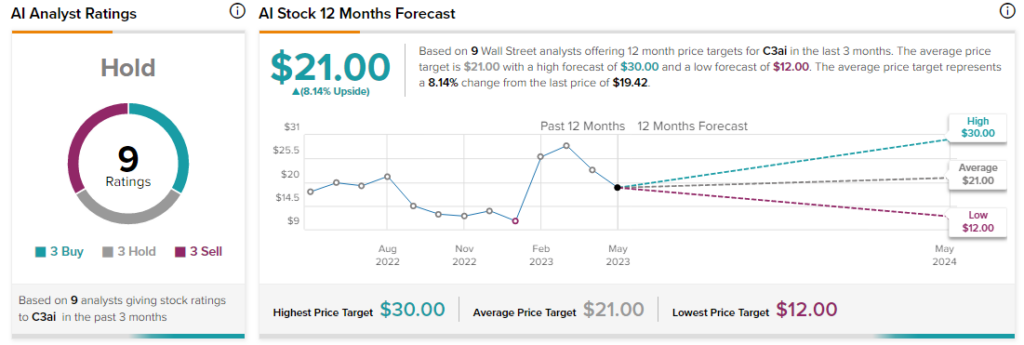

Analysts are sidelined about AI stock with a Hold consensus rating based on three Buys, Holds, and Sells each.