Shares of C3.ai (NASDAQ:AI) surged today after it responded to a recent short seller’s claims that the company was using deceptive accounting practices. Specifically, the short seller, Kerrisdale Capital, cited “highly conspicuous growth in unbilled receivables” that apparently reached levels that Kerrisdale had never seen.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, in terms of unbilled receivables, C3.ai said that “an unbilled receivable occurs when a subscription, license, or service was provided to the customer which, under U.S. GAAP, requires the revenue to be recognized in the current period under ASC 606, but some portion of the sales price is not yet due as the contractual billing terms specify the invoice date to occur after some portion of the subscription, license, or service has been provided.” C3.ai went on to say, “Contrary to Kerrisdale’s assertion, unbilled receivables and contract assets are quite common in the software industry.”

In addition, the short seller also claimed that the company’s gross margin from the Baker Hughes arrangement is over 99%, alleging that there was something wrong with that. However, C3.ai responded by saying, “The statement that our gross margin from that account is 99% is simply not true and cannot be inferred from our financial statements, as we do not provide that information on a customer-specific basis.”

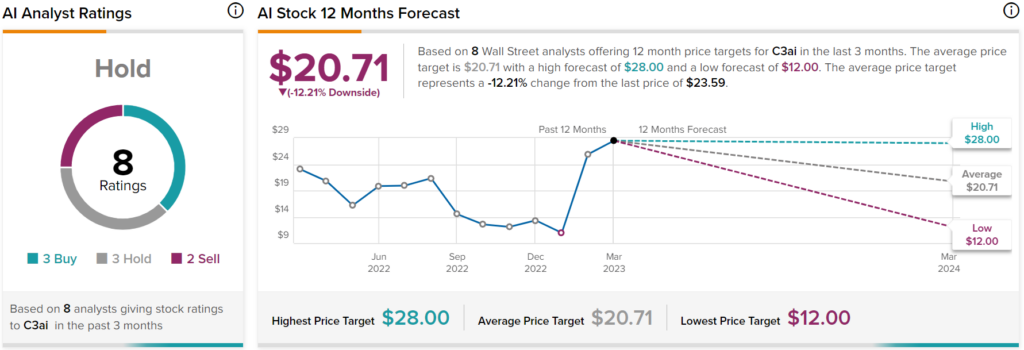

Nevertheless, Wall Street analysts have a consensus price target of $20.71 on AI stock, implying over 12% downside potential, as indicated by the graphic above.