C3.ai (NYSE:AI), the Enterprise AI application software company, declined in pre-market trading after the company’s second-quarter results left investors disappointed. The company generated total revenue of $73.2 million, up 17% year-over-year, and fell short of consensus estimates of $77.7 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Subscription revenue was $66.4 million in the second quarter, up 12% year-over-year, and comprised 91% of its total revenue. The company’s adjusted loss came in at $0.13 per share compared to a loss of $0.11 in the same period last year. Analysts were expecting the firm to report a loss of $0.10 per share.

In addition, C3.ai’s customer engagement increased by 81% year-over-year to 404 at the end of the second quarter.

Looking forward, the company anticipates Q3 revenue to be in the range of $74 million to $78 million, while its adjusted loss from operations is likely to be between $40 million and $46 million. In FY24, C3.ai projects revenue to land between $295 million and $320 million, while adjusted loss from operations is likely to be in the range of $115 million to $135 million.

What is the Future of C3.Ai Stock?

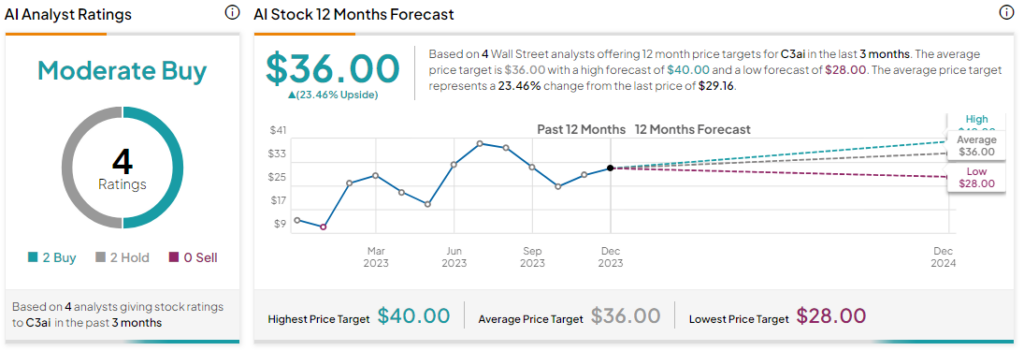

Analysts remain cautiously optimistic about AI stock with a Moderate Buy consensus rating based on two Buys and two Holds. Even as AI stock has surged by more than 100% year-to-date, the average AI price target of $36 implies an upside potential of 23.5% at current levels.