Shares of the AI software developer C3.ai (NYSE:AI) cratered 16% at the time of writing after the company announced it plans to increase investments in Generative AI solutions, potentially delaying its path to profitability. Despite delivering a solid earnings report, the firm retracted its earlier projection of attaining non-GAAP profitability by the close of Fiscal Year 2024. CEO Thomas Siebel emphasized the burgeoning global interest in enterprise AI adoption, pointing to a substantial market opportunity that the company is eager to capitalize on.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, this aggressive investment strategy has evoked mixed reactions from Wall Street. While the firm foresees a revenue range of $295 million to $320 million for the 2024 fiscal year, it has also projected a substantial non-GAAP loss, jumping from a previous estimate of $50-75 million to a steeper $70-100 million. Analysts have responded with caution. Dan Ives of Wedbush Securities, although retaining his outperform rating, trimmed his price target from $50 to $42, foreseeing a scenario of “near-term pain for long-term gain.” Conversely, Brad Sills of Bank of America maintained a Sell rating, citing a slow pace in securing pilot and expansion deals, predominantly limited to the energy and defense sectors.

What is the Future Price of AI Stock?

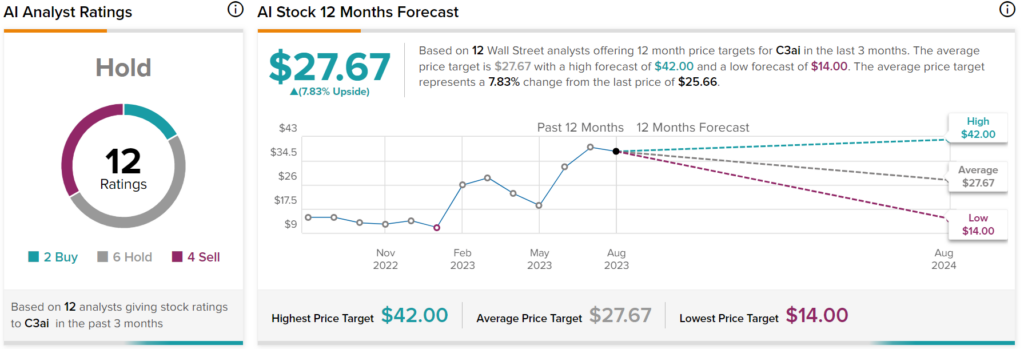

Turning to Wall Street, analysts have a Hold consensus rating on AI stock based on two Buys, six Holds, and four Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $27.67 per share implies 7.83% upside potential.