In the closing minutes of Friday’s trading session, ChargePoint (NYSE:CHPT) investors made it clear they were living for the weekend. They sold ChargePoint shares in a big way, sending prices down over 35%, building on losses seen in overnight trading. It was all thanks to a combination of factors ranging from a major shakeup in the top brass and going on from there to reach a series of deeply concerned analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The whole thing started when ChargePoint released its preliminary third-quarter earnings. It revealed that its actual results would likely come in below expectations, suggesting that third-quarter revenue would land between $108 million and $113 million. Given that earlier projections called for $150 million to $165 million, that’s a pretty big shortfall. ChargePoint cited “overall macroeconomic conditions,” of course, but also went on to describe delays in vehicle delivery and ongoing pressures in its primary markets. That, in turn, led ChargePoint to bring in a new CEO, Rick Wilmer, who started his job literally yesterday. Chief Financial Officer Rex Jackson was also out.

Analysts Turn on CHPT Stock

After all that, it’s little surprise that the analysts began to reconsider. And reconsider they did; at least four different firms—R.F. Lafferty, Janney Montgomery Scott, Oppenheimer, and Roth MKM—all downgraded their positions on ChargePoint over these exact matters. Roth MKM dropped from Buy to Neutral, noting that its recent capital raise likely won’t be enough to get it to profitability. Meanwhile, Thomas Meric at Janney did the same, noting that “several moving pieces” are likely to keep share prices “under pressure.” As a result, he lowered his price target to $5.

Is ChargePoint a Buy, Sell, or Hold?

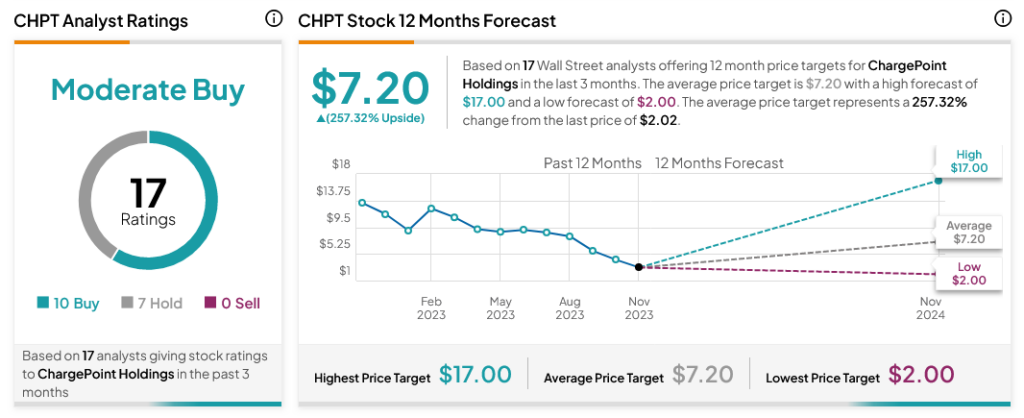

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CHPT stock based on 10 Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After an 83.82% loss in its share price over the past year, the average CHPT price target of $7.20 per share implies 257.32% upside potential.