Media company BuzzFeed (NASDAQ:BZFD) hasn’t exactly been doing well since its IPO. Considering that shares are in the sub-dollar range, that’s not much of a surprise. But it’s looking to raise some cash and claw its way back with some new division sales, and that’s got investors taking notice. In fact, BuzzFeed shares are up nearly 5% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Reports noted that BuzzFeed was looking to sell off not only First We Feast but also Tasty. In addition, Fortress Investments, who took over Vice Media, is poised to sell the women’s lifestyle-focused Refinery29. With revenues down from $30 million—and Vice Media having paid $400 million for it back in 2019—it’s clear that BuzzFeed et al. are looking to slim up operations and get them producing once more. Plus, in the closing days of 2023, there was word that BuzzFeed was set to sell off the Complex Networks business—or at least most of it—to Ntwrk for just over $100 million, which was less than it wanted to get.

A Monster Bill Coming Due

The trouble at BuzzFeed goes back to 2019 when BuzzFeed went on a massive expansion in a bid to draw more interest ahead of an initial public offering (IPO) via a Special Purpose Acquisition Company (SPAC). That led to BuzzFeed borrowing $150 million to buy Complex for $300 million—which made for $150 million out of pocket—and a bill come due later this year. With SPAC cash running out—it’s got about 5% of the original payday left—and its market cap in open decline, there’s going to be quite a butcher’s bill to pay coming up and not much to pay it with.

What is the Outlook for BuzzFeed Stock?

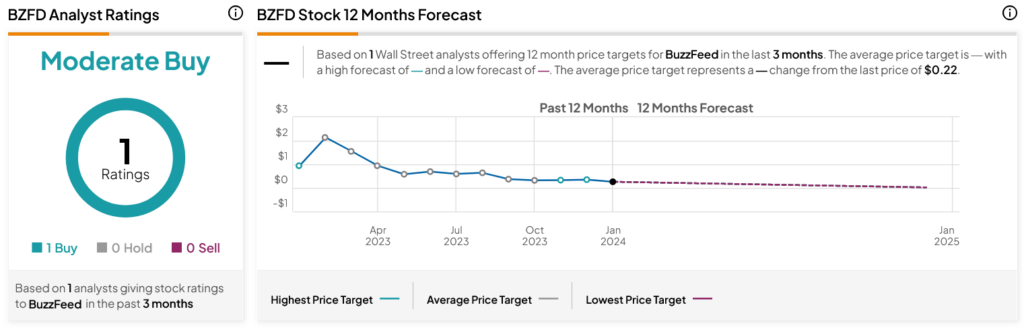

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BZFD stock based on one Buy assigned in the past three months by an unknown analyst with Craig-Hallum. After an 89.26% loss in its share price over the past year, BuzzFeed shares have no average price target and, therefore, have no known upside potential or downside risk.