As a close follower and investor in Nvidia (NVDA), I remain deeply bullish following its Q1 Fiscal 2026 earnings. Nvidia has firmly established itself as the cornerstone of the global AI revolution. Despite ongoing geopolitical risks, the company’s momentum feels unstoppable. Its ability to weather challenges like export bans with minimal disruption highlights not only its leadership and resilience but also its unmatched dominance in the AI landscape.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Record Revenue & Strong Margins

Nvidia reported an impressive $44.06 billion in revenue for the quarter, marking a 69% year-over-year surge. The Data Center segment alone generated $39.1 billion—up 73%—and now accounts for nearly 90% of total revenue, reflecting the company’s central role in powering the AI boom. Even after absorbing a $4.5 billion inventory charge related to China export restrictions, non-GAAP earnings stood strong at $0.96 per share, compared to $0.76 GAAP.

What’s even more compelling is the confidence signaled by management—Nvidia repurchased $14.1 billion in stock this quarter. Beyond being shareholder-friendly, it’s a strong vote of confidence in future upside. While margins dipped due to the inventory write-off, gross margin remained solid above 71% when excluding the charge. In short, Nvidia’s profitability engine is not just intact—it’s accelerating.

Surviving Geopolitical Heat Is Part of the Game

Geopolitics threw Nvidia a curveball lately, when the U.S. government banned exports of Nvidia’s H20 AI chips to China, effective April 9. This caught many investors off guard—after all, China is a sizable market. The $4.5 billion charge I mentioned was related to excess H20 inventory—looking ahead to Q2, Nvidia thinks it will miss approximately $8 billion in revenues as a result of these restrictions.

But what initially seemed like a massive issue has started to evaporate. CEO Jensen Huang acknowledged his concern about the long-term impact of these restrictions, outlining that they may actually fuel China’s strategic ambitions to build domestic capabilities and diminish U.S. revenue streams. Meanwhile, Nvidia is already redirecting sales to other countries in the Middle East and domestic customers, demonstrating its agility and resilience. While these geopolitical risks remain tangible, they’re not terminal for a company with combined global scale and technology leadership like Nvidia.

Nvidia’s strategy goes far beyond simply selling powerful GPUs. Jensen Huang’s recent remarks highlight how the company is positioning itself as the essential infrastructure backbone for global AI, much like OPEC’s role in the oil industry. As AI inference workloads surge tenfold year-over-year, nations and corporations worldwide are racing to secure computing power. Nvidia has smartly capitalized on this demand, forging strategic partnerships with countries like the UAE, Saudi Arabia, and Taiwan to build massive AI data centers and cement its dominance.

Premium Valuation Represents Tangible Strength

Nvidia trades at a premium—over 30x forward earnings—but that multiple may actually understate its value given the staying power of AI investor enthusiasm. When a company is growing revenue by 70% and pulling in over $40 billion a quarter, a rich valuation isn’t just justified—it’s expected. Even if growth cools slightly, Nvidia is still positioned for extraordinary performance over the next few years. In my view, it won’t be time to consider trimming AI infrastructure exposure until late 2026—if ever.

Sustained growth in the next few years is not merely hype—cloud giants like Microsoft (MSFT) and Google (GOOGL) continue to invest hundreds of billions of dollars in capital expenditures on AI infrastructure. Nvidia, as the picks and shovels provider in the gold rush, obviously sees sustained demand.

If Big Tech’s capex budgets taper, Nvidia can tap into the vast national AI market and begin dominating robotics technology at scale. Thus, the current valuation is grounded in realistic optimism rather than irrational exuberance, especially given Nvidia’s aggressive buybacks alongside the stable medium-term demand visibility.

Is Nvidia a Buy or a Hold?

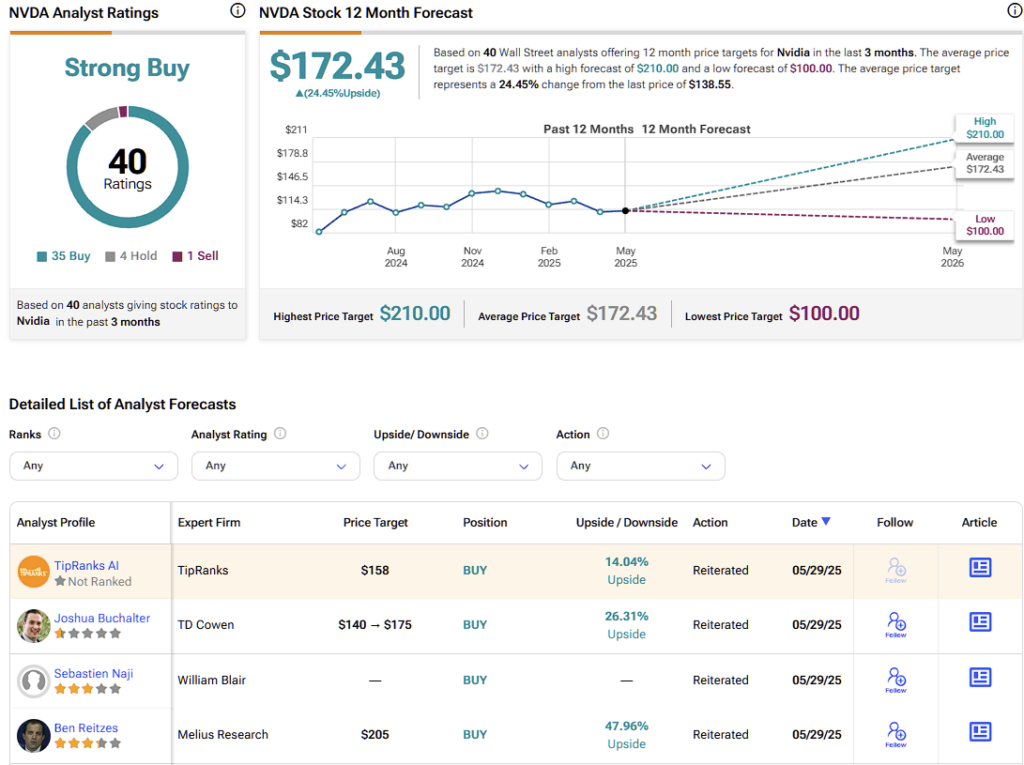

Wall Street overwhelmingly backs Nvidia with a Strong Buy consensus—35 Buys, four Holds, and just one Sell. NVDA’s average stock price target is $172.43, implying approximately 24% upside over the next year. Personally, I’m even more bullish, with a target closer to $190.

The Deus Ex Machina of the AI Economy

After reviewing Nvidia’s Q1 results and deepening my understanding of its strategy, my bullish conviction has only strengthened. Nvidia isn’t just selling GPUs—it’s leading a global AI infrastructure revolution. Geopolitical export restrictions to China are mere speed bumps, not existential threats.

With its strategic positioning, robust software ecosystem, unmatched partnerships, and soaring demand, Nvidia remains essential for any growth-focused portfolio. As countries and businesses increasingly leverage AI infrastructure for competitive advantage, Nvidia’s dominance looks set to continue—and I see no reason to bet against its ongoing leadership and growth.