When it comes to Tesla, Inc. (NASDAQ:TSLA), investors have a bit of a quandary. Is the company the sum of its current parts, its future aspirations, or perhaps a combination of the two?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s fair to say that this is often where the bear and bull cases break down. Those upbeat about Tesla tend to be looking up ahead to the potential AI bonanza, with visions of autonomous robotaxi fleets and humanoid robots powering TSLA to greater and greater heights.

The bears, on the other hand, are generally fixated on the here and now, with EV sales first and foremost on their minds. While the company’s Q3 EV deliveries of 497,099 set a new company record, critics are quick to point out that this was likely due to consumers pulling forward their purchases to capitalize on an expiring $7,500 EV tax credit.

Count investor Ryan Vanzo among those who are hopeful about the future technological land grab. While the investor notes that the company has been doing quite well recently, he believes additional gains are up ahead.

“This potential growth has little to do with manufacturing cars. Instead, it involves what could eventually become the biggest growth opportunity in history: artificial intelligence,” predicts the 5-star investor.

Vanzo acknowledges that TSLA’s share price is currently a bit expensive, both in comparison to its EV peers and according to its current business model. However, the investor argues that there’s a good reason for this.

The first is Tesla’s size and scale, with an established business and worldwide name recognition. This is no speculative play, notes Vanzo, who also mentions that during the past decade dozens of EV start-ups have folded.

Moreover, the robotaxi opportunity is beckoning, and the investor estimates it could generate more than $1 trillion in value for Tesla.

“Next year, the company expects to become a fully fledged AI operator of robotaxis, potentially more than justifying its current valuation,” adds Vanzo.

This makes the company’s updates must-see viewing, as progress in realizing the self-driving vision could translate into dollar signs for investors.

“Additional expansion could set up next quarter’s conference call – to be held in early 2026 – as a blockbuster opportunity to show huge growth in this promising division,” adds Vanzo. (To watch Ryan Vanzo’s track record, click here)

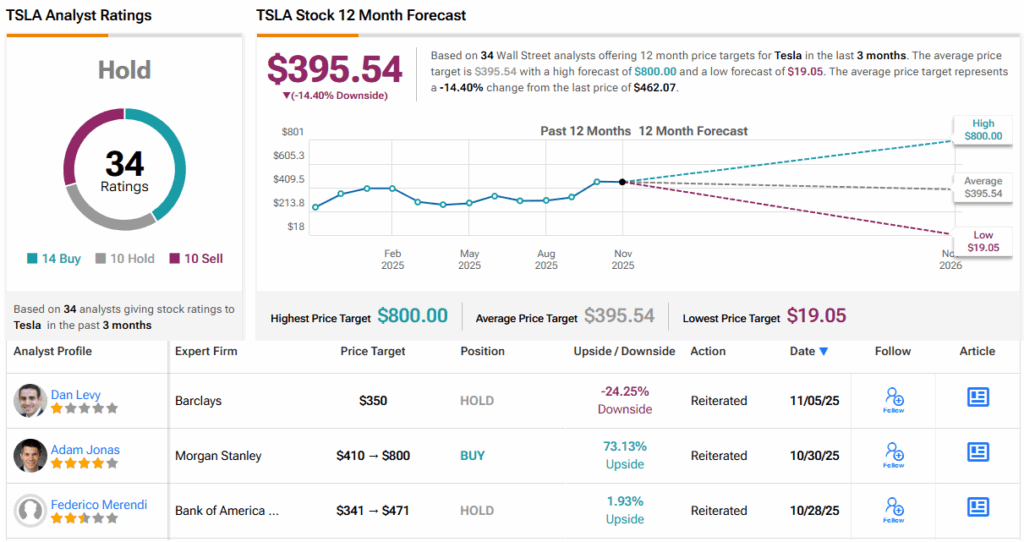

Wall Street is feeling a bit torn when it comes to Tesla. With 14 Buys, 10 Holds, and 10 Sells, TSLA carries a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $395.54 implies a downside of ~14%. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.