In the latest 13F filing, Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) disclosed that it has trimmed holdings in technology giant Apple (NASDAQ:AAPL). Further, Berkshire added shares of energy giant Chevron Corporation (NYSE:CVX) during the fourth quarter of 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Per the filing, Berkshire sold about 10 million shares of Apple in Q4. However, it still holds 905.56 million shares. At the same time, the firm added 15.8 million shares of Chevron. In terms of value, Apple remains Berkshire’s biggest holding, worth about $174.35 billion. Meanwhile, Chevron is its fifth largest holding, worth $18.59 billion.

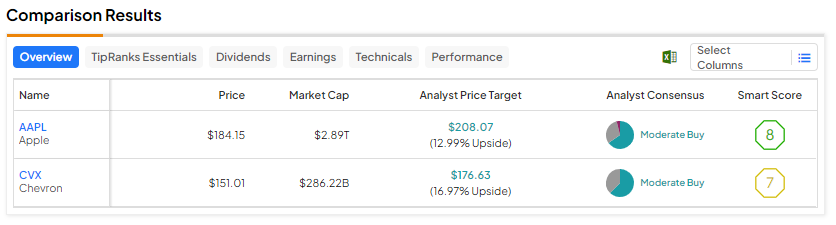

TipRanks’ Stock Comparison tool shows Wall Street is cautiously optimistic about AAPL and CVX’s prospects. Notably, Apple’s management highlighted during the Q1 conference call that its key market, China, has shown signs of softness. Meanwhile, Chevron is streamlining its portfolio and reallocating capital to more lucrative regions. Nevertheless, lower commodity prices continue to pose a short-term challenge.

What Did Berkshire Hathaway Buy?

Besides for Chevron, Berkshire increased its holdings in Occidental Petroleum (NYSE:OXY) and invested in the penny stock Sirius XM Holdings (NASDAQ:SIRI) during the fourth quarter.

In the meantime, the firm lowered its stake in Paramount (NASDAQ:PARA) and HP (NYSE:HPQ).

Further, Berkshire sold its entire holdings in DR Horton (NYSE:DHI), Markel (NYSE:MKL), Globe Life (NYSE:GL), and Stoneco (NASDAQ:STNE). Overall, Berkshire had 41 holdings in Q4, compared to 45 in Q3.