Warren Buffett-led Berkshire Hathaway Inc. (NYSE:BRK.A) (NYSE:BRK.B) continues to sell its Bank of America (BAC) shares, bringing its stake to below 10% following the latest sale. A regulatory filing dated October 10, showed that Berkshire sold an additional 9.55 million BAC shares, valued at $382.37 million. Following the latest Informative share sale, Berkshire now holds 775 million shares of BAC, worth $31.15 billion as per the latest closing price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Berkshire sold the shares in multiple transactions on October 8, 9, and 10 at weighted average prices ranging between $39.9175 and $40.1434 apiece. The latest sale also brings down Berkshire’s BAC ownership to 9.99%, below the 10% threshold (776 million shares), which means that Berkshire is no longer required to make frequent disclosures of its trades.

Possible Reasons for Berkshire’s Continued BAC Sale

The interesting thing about Buffett’s trade is its timing. Bank of America is set to release its Q3 FY24 results on October 15. Analysts are projecting a decline in both revenues and earnings, citing potential weakness in BAC’s near-term performance and interest rate uncertainty. Buffett set on a selling spree of BAC stock in mid-July and has made roughly $10.5 billion to date from the share sale.

Buffett possibly expects a large share price decline following BAC’s results, which is why he has undertaken most of the share sale before the earnings announcement. Berkshire might also be wary of the potential federal capital gains tax changes and implications following the upcoming U.S. presidential election.

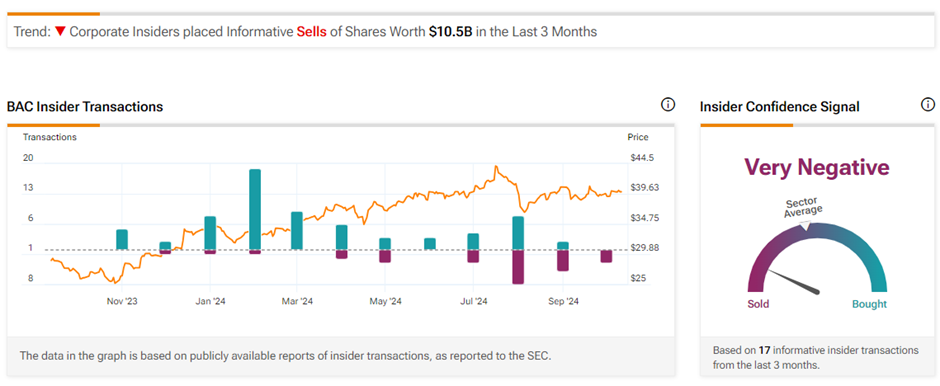

Insider Signal for BAC Stock

Notably, Bank of America stock currently has a Very Negative Insider Confidence Signal on TipRanks. BAC saw a massive $10.5 billion worth of Informative Sell transactions in the last three months. One of the largest contributors to the share sale has been Berkshire Hathaway.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

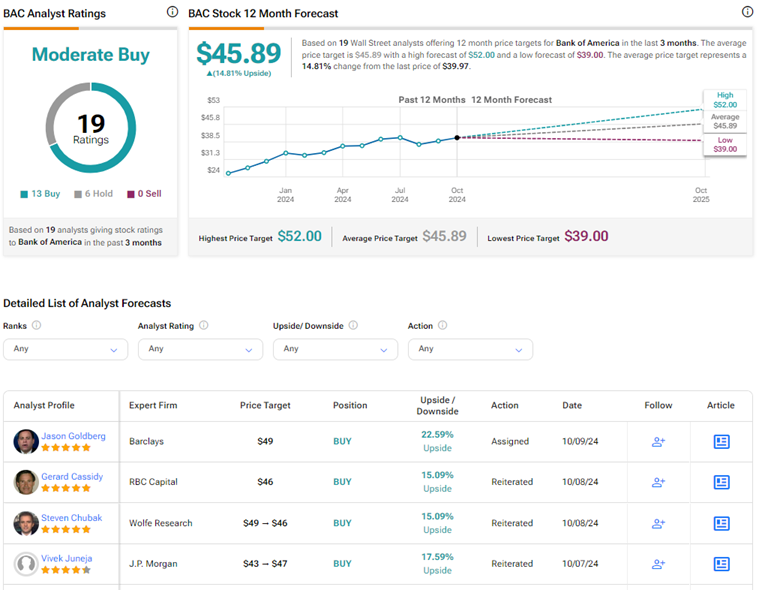

Is BAC a Buy or Sell?

Wall Street remains divided on Bank of America stock ahead of its Q3 print. On TipRanks, BAC stock has a Moderate Buy consensus rating based on 13 Buys versus six Hold ratings. The average Bank of America price target of $45.89 implies 14.8% upside potential from current levels. Year-to-date, BAC shares have gained 21.1%.