Chinese electric vehicle (EV) maker BYD (BYDDY) is rapidly emerging as a tough competitor for Elon Musk-led Tesla (NASDAQ:TSLA). PT Blue Bird, Indonesia’s largest taxi operator, has chosen BYD over Tesla for providing 80% of its EV fleet, reflecting a preference for BYD’s low-cost models, Bloomberg reported.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BYD, which is backed by Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B), has won most of the 500 EV orders to be delivered to PT Blue Bird this year. The orders mainly include BYD’s E6 and T3 models. PT Blue Bird’s President Director Sigit Priawan Djokosoetono believes that the price of these BYD models is “supportive” for the company to operate in the country.

Southeast Asia is a key market for BYD. The company has reportedly signed a preliminary agreement with the Indonesian government to build an EV plant in the country. This would mark the second plant for BYD in the Southeast Asia region, with the EV maker commencing construction on its first plant in Thailand in March.

Earlier this year, Tesla slashed the prices of some of its models in China and other Asian markets to boost demand. However, investors are concerned about the impact of these price cuts on the company’s margins.

Meanwhile, BYD is strengthening its position in the domestic market and also expanding internationally. Its deliveries increased about 93% year-over-year to 552,076 vehicles in Q1 2023 and earnings jumped 411%. BYDDY shares have risen 21% so far this year. It dethroned Tesla last year by delivering 1.86 million EVs compared to the U.S. EV maker’s 1.31 million deliveries.

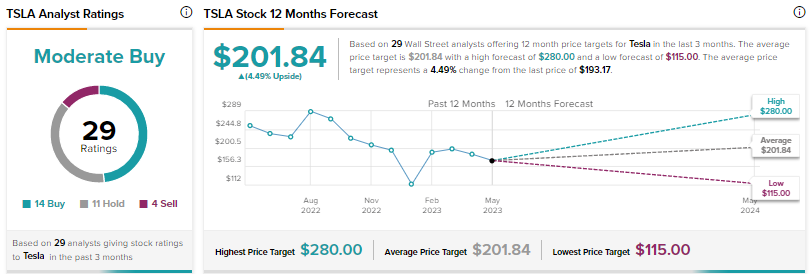

Is Tesla Stock a Buy, Hold, or Sell?

Wall Street is cautiously optimistic on Tesla due to rising competition and macro pressures. The average price target of $201.84 implies 4.5% upside. Tesla shares have rallied about 57% year-to-date.