For decades, Anheuser-Busch Inbev (NYSE:BUD) made a name for itself by selling alcohol. The idea that the Budweiser could sell its primary stock in trade—beer–without any alcohol might sound a bit farfetched at first. However, the market doesn’t seem particularly concerned and gave Bud a slight uptick in Monday afternoon trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Word from Evercore ISI analyst Robert Ottenstein notes that the idea of alcohol-free beer isn’t that outlandish. In fact, Ottenstein considers it a “…key growth segment” for brewers like Bud. Ottenstein then noted how the “stigmas” around non-alcoholic beer have been falling away.

More and more customers are turning to unusual beverage choices like hard seltzer. That’s enough of a market move to give Ottenstein some real confidence in Bud. Not only does he have an “outperform” rating on the company, but he also has a $70 price target on it as well.

In fact, other reports suggest that this could be a bigger market move than some expect, as consumers are increasingly seeking out low or no-alcohol options. A report from Fact.MR notes that the low-alcohol beverage market in the U.S. alone is projected to be worth $1.2 billion by the end of 2023. That represents a compound annual growth rate of 4.5%.

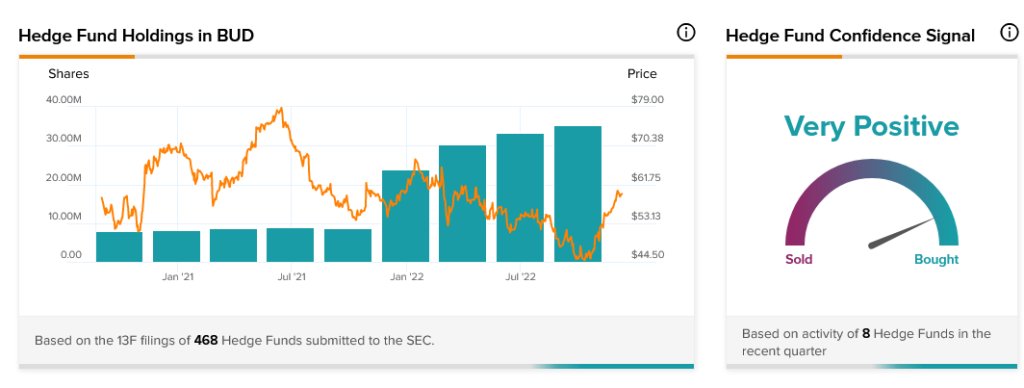

Hedge funds are agreeing with Ottenstein’s projections, as they’ve been adding to their holdings continually since October 2021. Hedge funds picked up an extra 1.2 million shares just in the last quarter.