Shares of chip giant, Broadcom (NASDAQ: AVGO) rallied in morning trading at the time of publishing on Tuesday as Wall Street analysts overall remain bullish on the company and expect upbeat results. The company is expected to announce its fiscal Q2 results on June 1. Broadcom’s stock price is currently hovering near its yearly high of $921.78.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Top-rated JP Morgan analyst Harlan Sur while not rating the stock, is of the opinion that Broadcom’s custom-chip business could be getting “accelerating orders from Google for its advanced AI processor chip called TPU” and could see sales of $4 billion of TPU chips next year.

The analyst noted that Broadcom expects to generate $3 billion in revenues from total cloud custom chip (ASIC) shipments this year, which would exceed the company’s sales of $2 billion last year. But Sur believes that even these estimates could be conservative as the “recent order acceleration from Google for its TPU AI processors implies that Google’s TPU processor program alone could drive $3B in revenues and implying upside to management’s prior cloud ASIC revenue target this year.”

Even top-rated KeyBanc analyst John Vinh echoed the same view and reiterated a Buy rating on the stock. The analyst has a price target of $820 on the stock, implying a downside potential of 5.2% at current levels.

The company is benefitting largely from multiple upgrade cycles in both broadband and networking and the demand for custom ASIC chips. Vinh commented, “We expect AVGO to post in line to slightly higher results and guidance.”

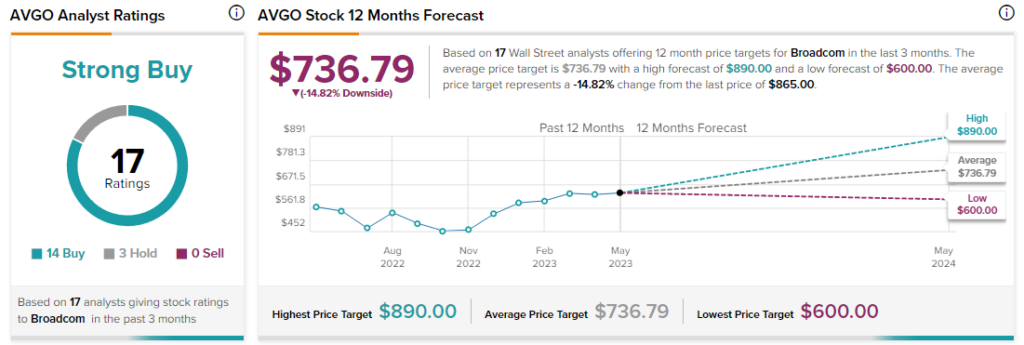

Analysts are bullish about AVGO stock with a Strong Buy consensus rating based on 14 Buys and three Holds.