U.S. chipmaker Broadcom (NASDAQ:AVGO) is likely to make an antitrust appeal to the European Union for early approval of its $61 billion buyout proposal of cloud computing and cybersecurity player VMware (NASDAQ:VMW), according to a report by Reuters.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

People familiar with the matter said that Broadcom plans to justify its case by arguing that the deal stands to strengthen competition in the cloud market with the likes of Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google-parent Alphabet (NASDAQ:GOOGL), rather than weaken it.

Reflecting the company’s thoughts, the people close to the developments said that the deal does not pose any real threat to competition, and therefore should be exempted from moving to the European Commission’s four-month-long second phase investigation.

The deal, which was announced in May this year, will help Broadcom expand in the enterprise software market. The company is yet to make an appeal for early approval. The deal comes at a time when tech partnerships are drawing intense probes from regulators worldwide. The main concern behind the regulatory crackdowns is power concentration.

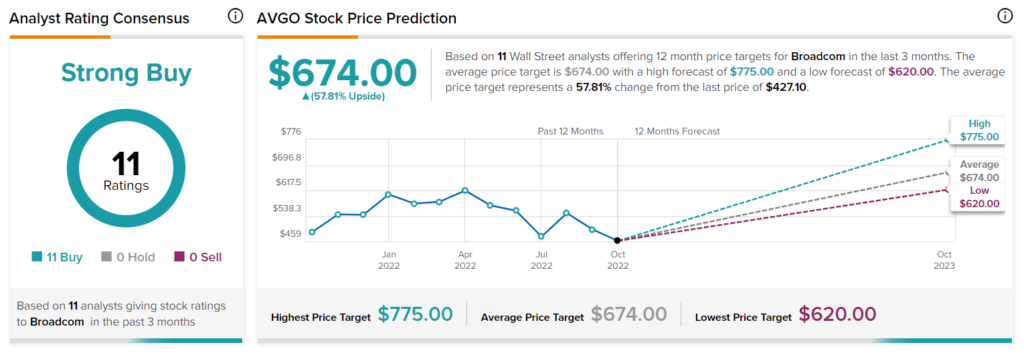

Is AVGO a Buy or Sell?

Wall Street is bullish on Broadcom stock, with a Strong Buy rating based on 11 unanimous Buys. The average price target on AVGO stock is $674, which indicates a 57.81% upside to the current price level.