Broadcom (NASDAQ:AVGO), a leader in the semiconductor stock space, recently posted its earnings report. While it wasn’t exactly a huge winner, and investors reacted badly, sending Broadcom down nearly 5% in Friday afternoon’s trading session, there were still silver linings in this dark cloud. The earnings report itself was a winner, and analysts actually came out in defense of Broadcom, citing the sheer value of artificial intelligence that Broadcom is now part of.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analysts referred to “AI tailwinds” in their support of Broadcom, and not without reason. Ambrish Srivastava, analyst with BMO Capital, summed it up by saying that most of Broadcom’s business is stable, but the AI work it’s doing has substantial growth potential. That was a point underscored by Hock Tan, CEO of Broadcom, who noted that Broadcom’s chip unit would have been flat against the third fiscal quarter of 2022’s figures had it not been for generative AI and what Broadcom’s doing therein.

Further, it’s worth noting that Broadcom’s results weren’t all that bad, with or without AI. Broadcom posted earnings of $10.54 per share, beating expectations, as did the revenue figure of $8.88 billion. That’s actually up 5% against this time last year, again, owing to those AI tailwinds. However, one point that left investors flat was Broadcom’s projections. Fourth quarter revenue is projected at $9.27 billion, which is lower than what analysts expected.

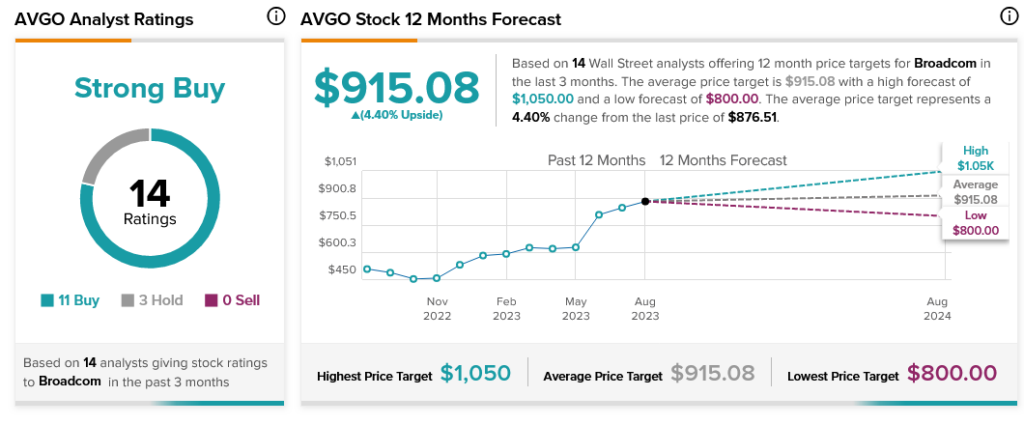

Even as investors depart, analysts are still quite clearly on board. With 11 Buy ratings and three Holds, Broadcom stock is considered a Strong Buy by analyst consensus. Further, Broadcom stock offers investors a 4.4% upside potential thanks to its average price target of $915.08.