Broadcom (NASDAQ:AVGO) saw its shares jump by almost 10% at the time of writing, energized by Citi’s Buy rating and price target of $1,100. Citi’s thumbs-up is due to Broadcom’s solid core business performance and the expected benefits from its recent VMware acquisition.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Citi analysts, led by Christopher Danely, are particularly bullish about Broadcom’s future in AI infrastructure. They predict sales in this area to double from $4B in Fiscal Year 2023 to over $8B in Fiscal Year 2024, compensating for any downturn in the semiconductor sector.

As for the $69B VMware deal, Citi’s team believes this acquisition could add a whopping $12.50 to Broadcom’s Fiscal 2025 EPS. This equates to a 34% increase.

Looking ahead, Citi envisions Broadcom achieving peak earnings per share of $60.00, driven by gross margins of 78% and operating margins of 58%.

What is the Price Target for AVGO?

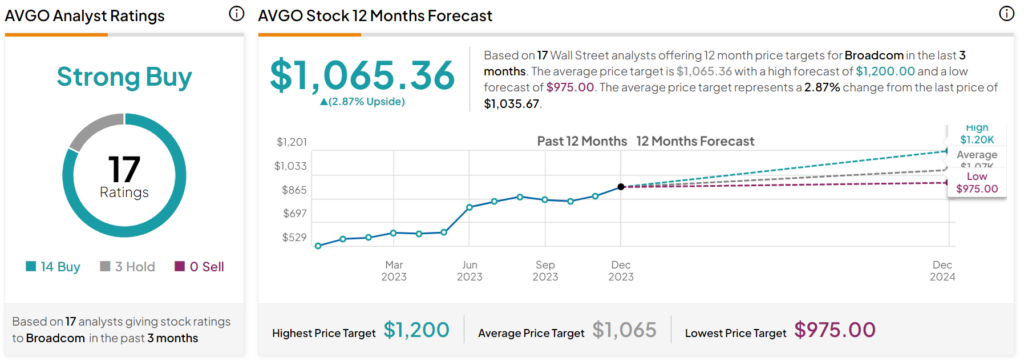

Turning to Wall Street, analysts have a Strong Buy consensus rating on AVGO stock based on 14 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 91% rally in its share price over the past year, the average AVGO price target of $1,065.36 per share implies only 2.9% upside potential.