Bristol-Myers Squibb announced a $2 billion share buyback program, sending shares of the biopharmaceutical company up 4% on Monday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bristol-Myers’ (BMY) additional share buyback plan brings the total stock repurchase authorization to approximately $6.4 billion.

Separately, Bristol-Myers announced the collaboration with healthcare company, Grail, to evaluate early detection technology for cancer MRD (minimal residual disease). (See BMY stock analysis on TipRanks).

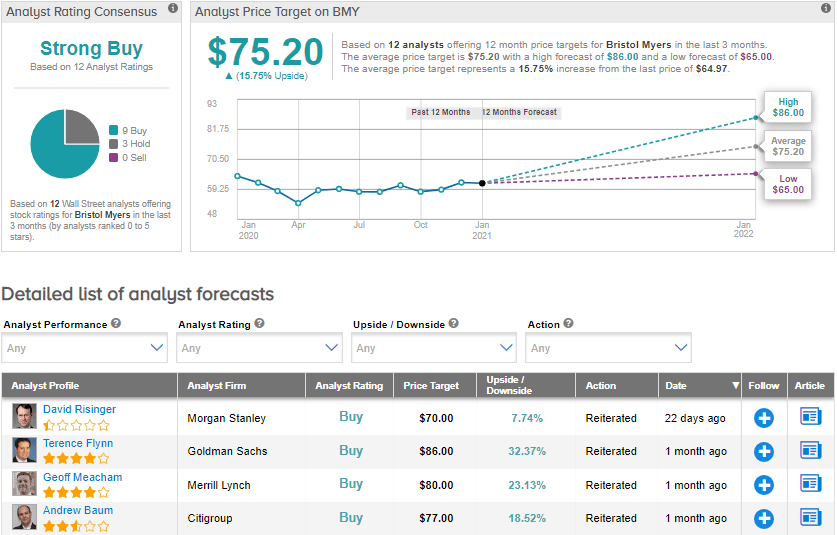

On Dec. 15, Goldman Sachs analyst Terence Flynn raised the stock’s price target to $86 (32.4% upside potential) from $82 and maintained a Buy rating. The analyst said that the company’s commercial execution, robust product pipeline, and FDA approvals would help drive significant growth. Flynn added that he expects the company to generate revenue of $13 billion in 2025.

From the rest of the Street, the stock scores a bullish outlook with the analyst consensus of a Strong Buy based on 9 Buys and 3 Holds. The average analyst price target of $75.20 implies upside potential of about 15.8% to current levels. Shares have gained 2.4% over the past year.

Related News:

Chemung Financial Approves New Share Buyback Program; Street Says Hold

Tegna Spikes 9% On 4Q Preliminary Results, Share Buyback Plan

Annaly Capital To Buy Back $1.5B In Stock; Street Is Bullish