Asset management firm Bridgewater Associates, founded by Ray Dalio, increased its stake in Super Micro Computer (SMCI) during the third quarter of 2024. According to recent SEC Form 13F filings, the hedge fund added approximately 1.45 million shares, marking a 921% increase from the prior quarter. This boost comes despite SMCI facing potential delisting risks from Nasdaq due to unresolved financial reporting issues, which have raised concerns among investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Super Micro is a provider of server and storage solutions that offers energy-efficient products for data centers and enterprise applications.

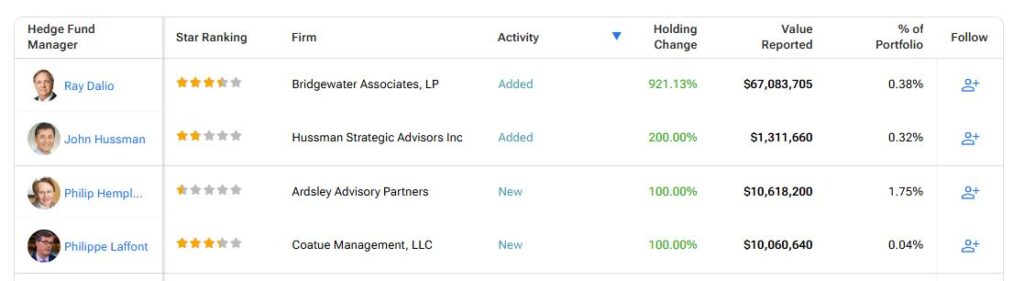

Hedge Funds Show Growing Confidence in SMCI

Bridgewater is not the only hedge fund increasing its position in SMCI. Other notable institutional investors have also shown confidence in the stock:

- Hussman Strategic Advisors Inc., led by John Hussman, increased its SMCI holdings by 200%, with an investment of $1.31 million, reflecting a 0.32% stake in the company.

- Ardsley Advisory Partners, managed by Philip Hempleman, took a new position in SMCI, investing $10.6 million, which represents a 1.75% stake.

- Coatue Management, headed by Philippe Laffont, also entered a new position, investing $10.06 million, though this accounts for just a 0.04% stake.

SMCI Hedge Fund Trading Activity

Stock Price Drops amid Multiple Concerns

Once a favorite among investors due to its strong growth in AI infrastructure, SMCI stock has dropped nearly 60% in the past six months.

The stock has fallen sharply due to several concerns, including the resignation of its auditor, who cited doubts about management’s reliability. Additionally, the company’s failure to meet Nasdaq’s deadline on November 20 worsened the situation. The Department of Justice is also investigating SMCI’s financial practices, raising concerns about its business operations.

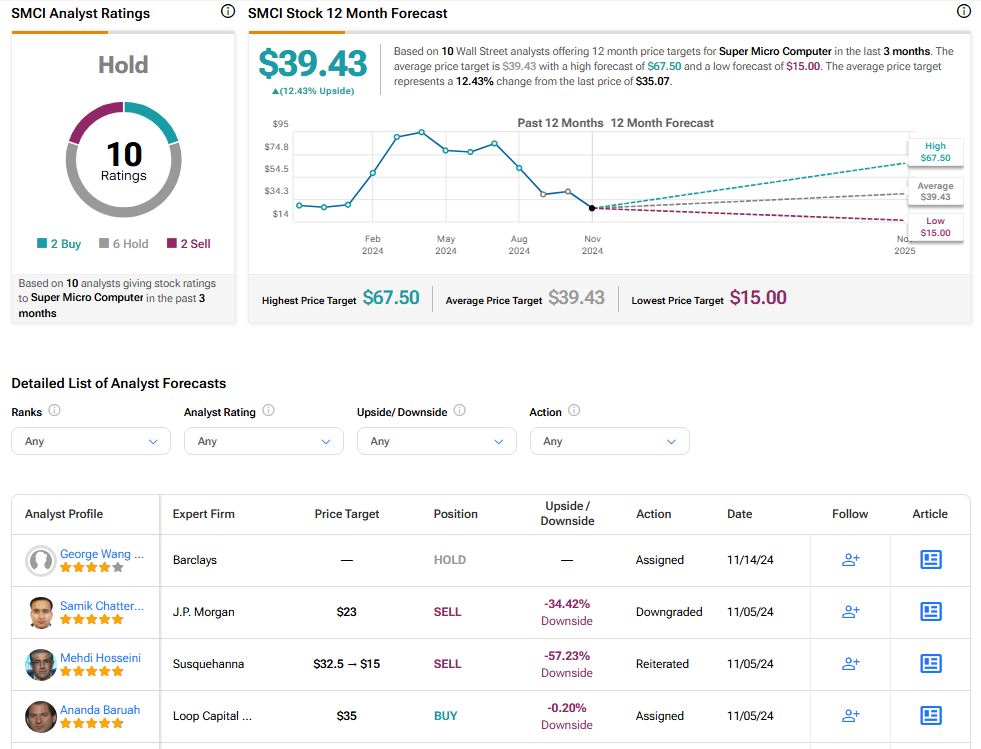

Is SMCI Stock a Buy?

Turning to Wall Street analysts, investor sentiment remains cautious. According to TipRanks, SMCI holds a Hold consensus rating based on two Buys, six Holds, and two Sell ratings assigned by analysts in the past three months. The average SMCI stock price target is $39.43, implying 12.43% upside potential.

This upside suggests that while risks remain, there’s hope the stock could bounce back if the company fixes its financial issues and continues to capitalize on the growing demand for AI infrastructure.