I know that yesterday I brought you news about another recall at legacy automaker Ford (F), which featured the Mustang line having prematurely damaged seatbelt pretensioners. Today, I have a completely new recall notice that, this time, impacts brake performance on certain models of Escape. And this latest recall sent Ford shares into yet another slump, down modestly in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

There are 13,451 units of the Ford Escape made in 2020 that suffer from this issue, described as a “…potential reduction in braking performance.” Such a reduction could increase the time and distance it takes to stop the vehicle, which in turn causes a hike in the potential for crashes, especially if you need to stop suddenly while driving a 2020 Ford Escape.

The issue, reports note, is “…rear brake linings with low friction coefficient,” and will require the front brake pads be replaced. That will, as ever, happen at dealerships, and will be done at no charge to the drivers. Apparently some of these were made without a brake vacuum booster that had a vacuum sensor included, which made the booster more likely to malfunction, and cause the conditions listed previously.

Earnings Hit Tomorrow

Meanwhile, Ford’s earnings report is set to hit tomorrow, and with it, we may end up with an idea of how much Ford has shelled out this quarter alone on recalls just like this one. But we also have early projections in to potentially compare tomorrow’s actual numbers.

Analysts currently look for revenue to come in around $46.33 billion, which will be down from last quarter, but on par with the third quarter of 2024. It is worth pointing out, though, that $46.33 billion back in 2024’s third quarter represented a hefty 5.5% increase in the fourth quarter of 2023, according to reports. Adjusted earnings, meanwhile, are set to come in around $0.36 per share. Generally, the projections prove accurate, as Ford has only missed estimates once in the last two years.

Is Ford Stock a Good Buy Right Now?

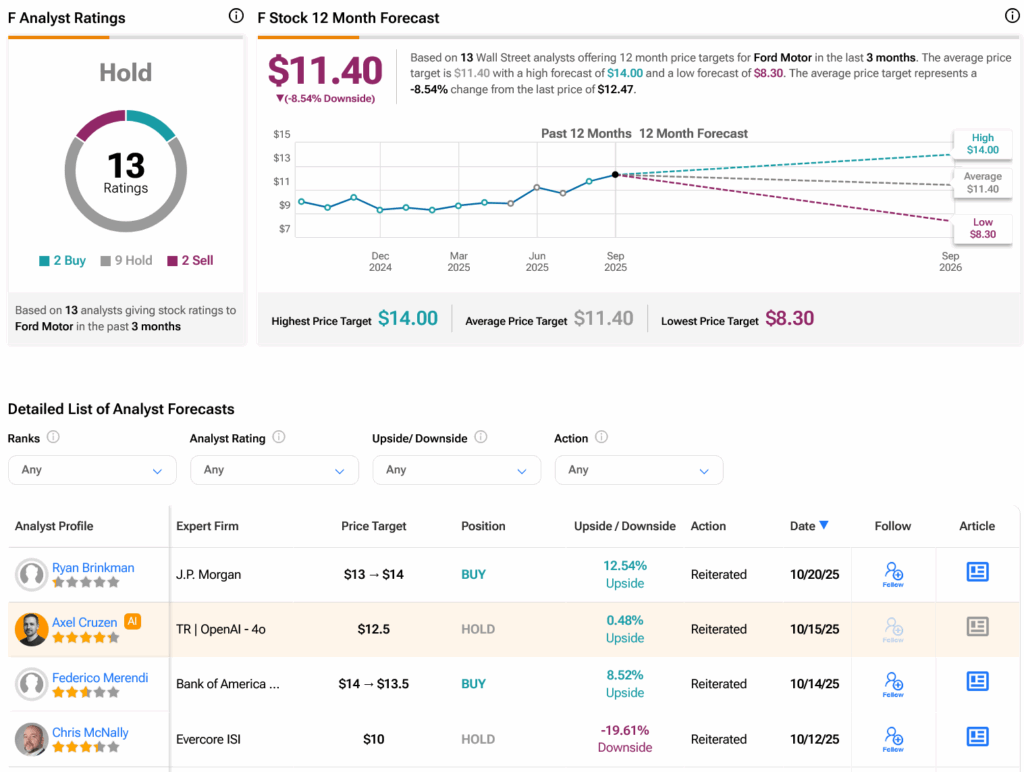

Turning to Wall Street, analysts have a Hold consensus rating on F stock based on two Buys, nine Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 13.56% rally in its share price over the past year, the average F price target of $11.40 per share implies 8.54% downside risk.