Treating amyotrophic lateral sclerosis (ALS), otherwise known as Lou Gehrig’s disease after the baseball player who made it a household name, has long been a challenge. But biotech stock Brainstorm Cell Therapeutics (NASDAQ:BCLI) notched up fractionally in Monday afternoon’s trading thanks to its own efforts on this front.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Brainstorm will be meeting with the Food & Drug Administration (FDA) regarding its new cell therapy, NurOwn, which is designed to treat ALS. The meeting is set for December 6 and will mainly focus on a Phase 3 trial that Brainstorm will subsequently use to re-submit its Biologics License Application for NurOwn. Brainstorm pulled the previous license last month, as the FDA wanted to discuss the path that regulators would want the treatment to take. So it looks like NurOwn will be allowed to get back on track, ultimately.

The FDA Has Concerns about NurOwn

Back a month ago, when Brainstorm pulled the original license, it did so with some concerns coming out of the FDA. The concerns were over the worst thing that a biotech stock can face when discussing one of its products: issues of safety and efficacy. Briefing documents from the FDA revealed that there wasn’t “sufficient evidence” to support clinical benefit for NurOwn and even noted that there were “large amounts of missing data,” according to one report. The FDA even noted that the treatment group suffered a “higher incidence of deaths” and further noted “a lack of survival benefit” that required further investigation. Ostensibly, this will be Brainstorm’s attempt to clear the matter up, though only time will tell if it has any real impact.

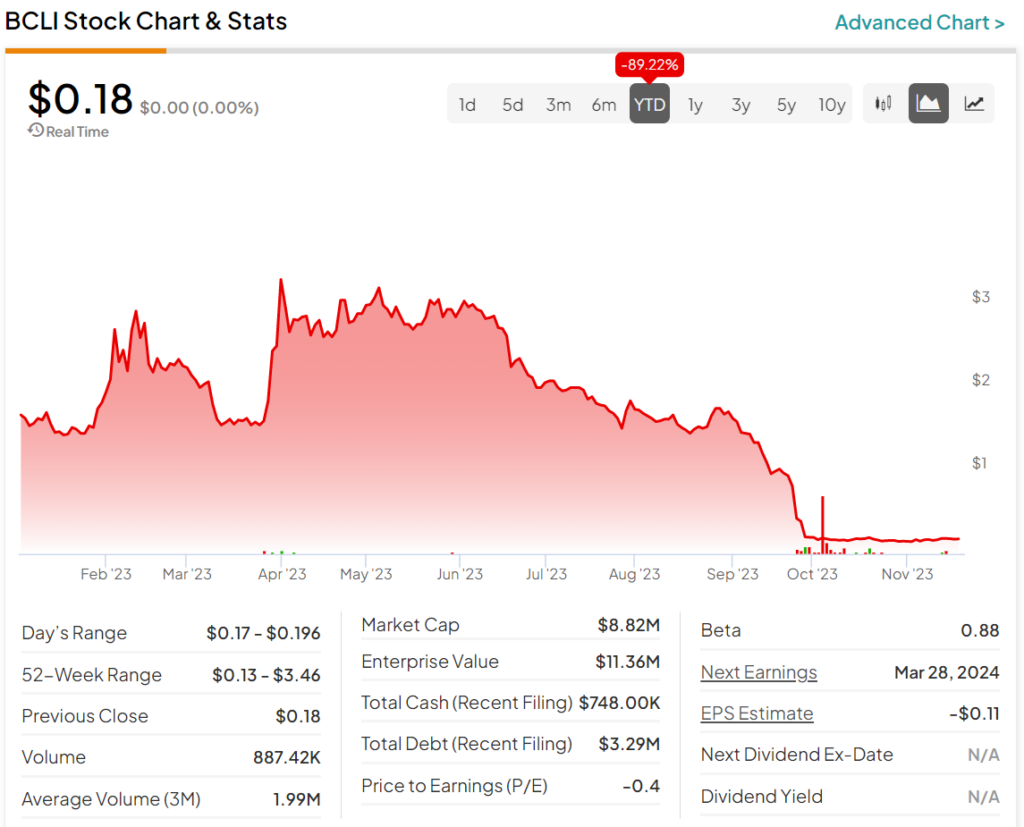

Is BCLI a Good Buy?

A look at the year-to-date performance for BCLI stock shows a painful period for investors. Indeed, the stock is down over 89% during this time frame. As a result, the stock hasn’t been a good buy, and has shown little signs of recovery.